This week was supposed to be a big deal. All eyes were on the Fed’s big Wednesday announcement. And then… crickets. Despite all the hype, the interest rate rollercoaster didn’t even leave the station.

Look, nobody with a pulse in the mortgage world actually expected a rate cut this week. Still, that didn’t stop some folks from sharpening their pitchforks when it didn’t happen. But let’s remind ourselves of a key point:

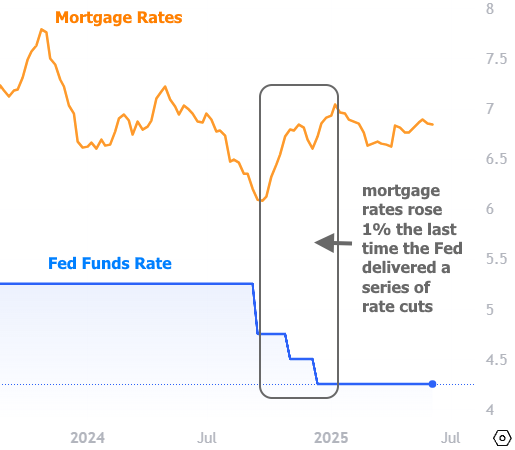

The Fed doesn’t directly control mortgage rates. That’s right! Mortgage rates are like that one friend who listens to your advice but ends up doing their own thing anyway. The Fed sets the Fed Funds Rate, which can influence mortgage rates—but usually only in broad, macroeconomic, zoomed-out kind of ways.

So, was there anything remotely spicy in the Fed announcement? Eh… sort of. There was the release of the dot plot—a handy-dandy chart where each Fed member plays “Rate Forecast Bingo” and marks their guess for where interest rates are headed. Some dots moved lower, some went higher, and overall, it was about as unified as a group chat trying to pick a dinner spot.

The confusion? Tariffs. (Yes, again.) Some Fed folks think tariffs will hurt the economy (so: rate cuts), while others fear they’ll stir up inflation (so: hold those rates high). And until that economic tug-of-war has a clear winner, the Fed’s plan is to…wait.

Spoiler alert: this didn’t move the needle much for rates.

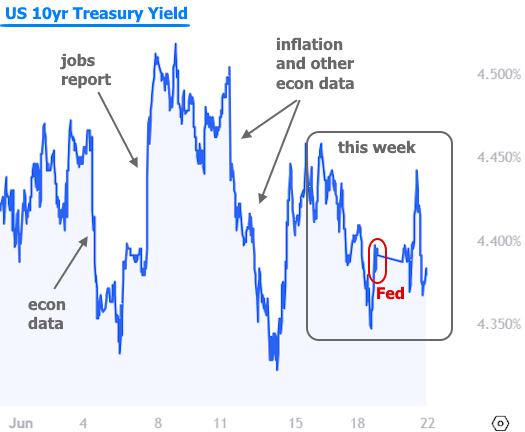

Meanwhile, actual economic data has had a bigger impact. Just check out this chart of 10-year Treasury yields—a popular benchmark that mortgage rates tend to follow like a little sibling with hero worship.

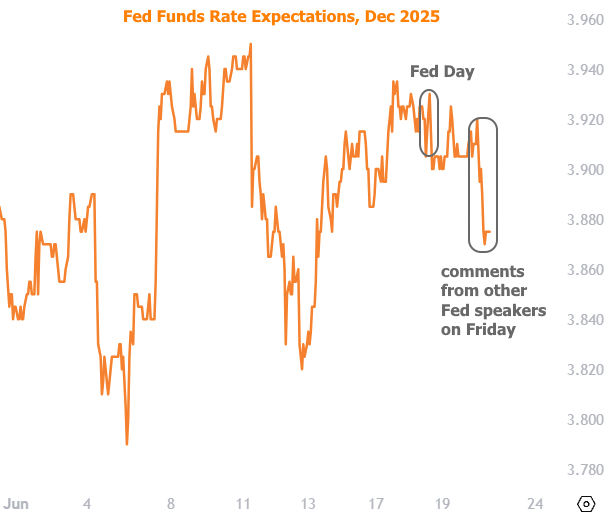

Now here’s where things got mildly interesting. A few Fed members gave public comments on Friday, and—shocker!—those moved markets more than the big-deal Fed meeting on Wednesday. Wild, right?

One of the more headline-worthy quotes came from Fed’s Waller, who suggested: “Hey, maybe we start cutting rates a little now and see how it goes, rather than waiting for things to break.” (Okay, we paraphrased. But that was the vibe.)

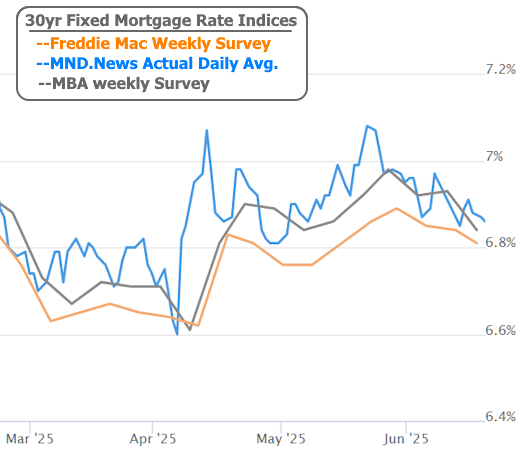

All in all, mortgage rates have been drifting gently downward ever since they peaked back on May 21st. Picture a feather falling. Slowly. In slow motion. Over a couple weeks.

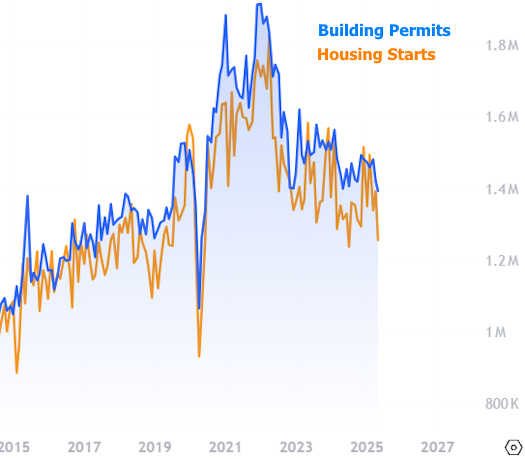

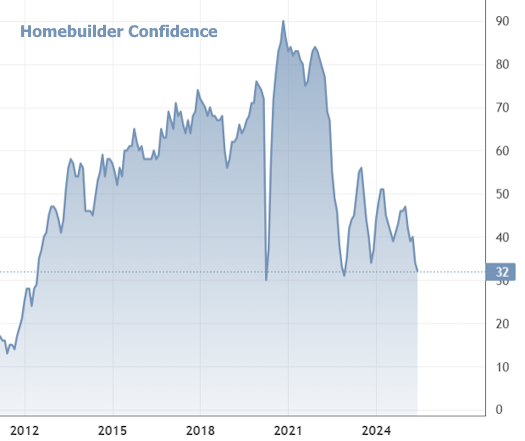

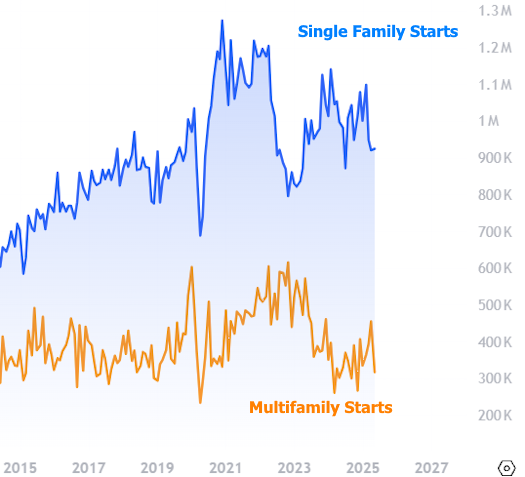

Now let’s talk housing. It’s… not great. Construction activity is still sluggish. Builder confidence and housing starts are hovering near recent lows. Basically, the vibe is “meh.”

But hey, if you dig into the data, there’s a tiny ray of sunshine: single-family home starts ticked up just a bit. The real drag came from the multifamily sector, which clearly hit the snooze button.

Looking ahead to next week: buckle up for more housing data. We’ve got home price indexes on Tuesday, new home sales on Wednesday, pending home sales on Thursday, and—wait for it—a key inflation report (PCE) on Friday. Oh, and Fed Chair Powell will be back on the mic with his semiannual testimony to Congress. (Popcorn optional.)

Until then, enjoy the slow-mo mortgage market. At least it’s not going up, right?