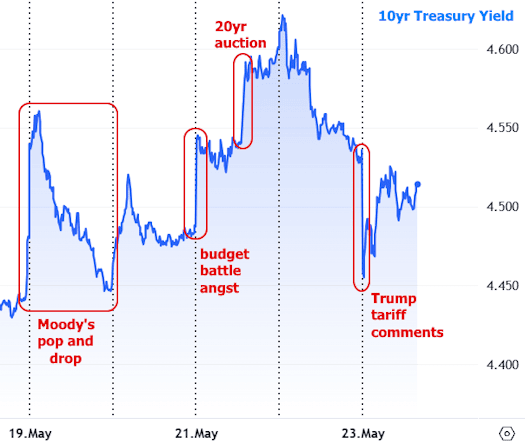

Markets kicked off the week in a bit of a funk, still nursing a hangover from Moody’s late-Friday surprise downgrade of the U.S. credit rating. You know it’s bad when both stocks and bonds wake up cranky.

When bonds “lose ground,” that’s market-speak for “Oh no, rates are going up again!” Prices drop, yields climb, and mortgage folks everywhere clutch their coffee cups a little tighter. Monday did try to make amends—most of the losses were recovered by the day’s end—but the good vibes didn’t stick. By midweek, bonds had thrown in the towel and wandered back toward their highest yields in months. Classic commitment issues.

Translation: Weak bonds = higher interest rates.

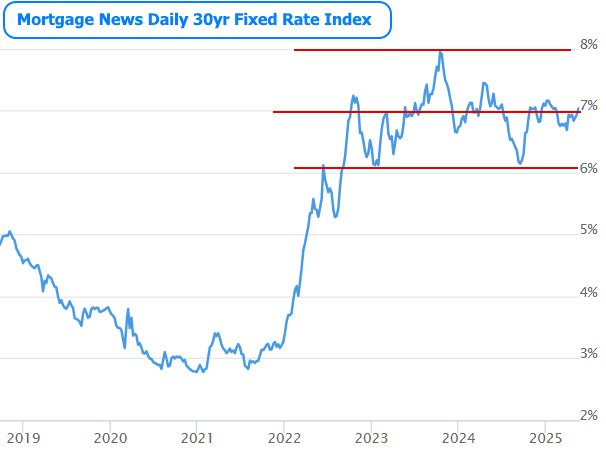

And boy, did the mortgage market feel it. Mortgage News Daily’s 30-year fixed rate index hit a 3-month high, chilling above 7% for three straight days like it was on a mini-vacation it didn’t want to end.

7% mortgage rates? Been there, done that.

Let’s not panic though. We were hanging out at 7% back in February, and remember October 2023? That was our brief rendezvous with 8.03% (we don’t talk about that month). Then we slid back down toward 6% a year later. So, yeah… 7% is basically the khakis of mortgage rates—right in the middle and not exciting anyone.

But here’s the catch: this middle-of-the-road thing is dragging on like a dinner party where no one wants to leave. And unless something dramatic happens—like one of the following—rates are probably staying parked here:

- Inflation throws in the towel and takes a dive

- The economy takes a sudden nap

- Congress holds hands, sings “Kumbaya,” and reduces the deficit

That last bullet point? Definitely not happening this week. Bond traders were not impressed with Congress’s “meh” approach to spending cuts during debates on the current bill.

Why do bond traders care about Congress’s spending habits?

Because the U.S. funds its operations by selling Treasuries, and if we’re spending like it’s Black Friday every day, we need to sell a lot of debt. More Treasuries = lower prices = higher rates. It’s basic supply and demand, but with more yelling.

Things came to a head Wednesday afternoon with a 20-year Treasury auction that landed with a dull thud. Normally, not a huge deal—but with all the deficit drama in the background, it felt like yet another slap from the bond market saying, “Get it together!”

There was a minor bounce back on Thursday and early Friday, helped along by Trump casually suggesting a 50% tariff on the EU (because why not?). That gave bonds a brief breather, but by the week’s end, yields were still up compared to last week—just not quite as punchy as midweek highs.

So, where does that leave us?

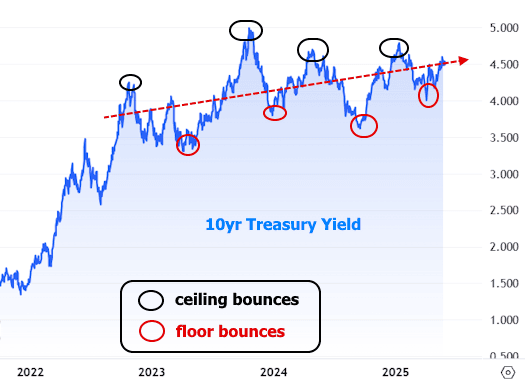

Honestly, we’re stuck in a holding pattern. The big story isn’t what is happening, it’s what isn’t. May has been trying—really trying—to spark a rally toward lower yields, but so far, it’s like trying to start a fire with damp matches.

We’ve seen better efforts earlier this year (the chart below has the red circles of disappointment). This latest one? Barely a whimper. The result is a slow drift sideways—or slightly up—when it comes to yields and mortgage rates. Until one of our three magic bullets finally hits the target, we’re likely to stay stuck in this “meh” market.

Hang in there, mortgage warriors. At least we’re not talking about 8%… yet.