Inflation is basically the big, bad wolf huffing and puffing at interest rates’ door these days, and this week, it seemed like the wolf had a megaphone. Thanks to two gossip mongers from the Bureau of Labor Statistics, interest rates did a little jump higher. Let’s introduce the culprits: the Consumer Price Index (CPI) and its cousin, the Producer Price Index (PPI). Both reports, though from the same family, told tales of inflation but with different spices.

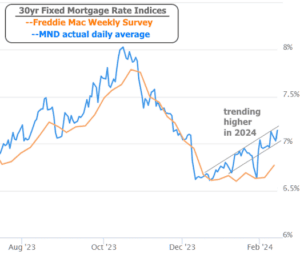

First up, the CPI, a notorious drama queen in the financial markets, made headlines again. It seems like rates have developed a bit of a sensitivity issue with CPI, reacting to even the smallest whispers of change. This time around, a tiny deviation from the expected had mortgage rates climbing to their highest peak in 2 months, as if trying to escape.

Then there’s the PPI, the less dramatic cousin, who hasn’t stirred the pot much in recent years. But hold your horses; late 2023 saw PPI taking a nosedive, hinting that maybe, just maybe, inflation was taking a chill pill. Yet, this week, PPI decided to join the drama club, adding a bit of salt to the wound CPI had already inflicted three days prior.

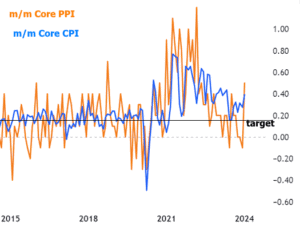

We even have a chart to show the main event of both reports, focusing on the “core” reading which is like the secret sauce that gets markets all fired up, minus the temporary zing from food and energy prices. Note: core PPI is like a wild horse compared to the more stable core CPI.

Despite the volatility, this spike in PPI was the biggest gossip in 2 years, reaching heights not seen in ages. Luckily, the markets still don’t dance to PPI’s tune as much, so the fallout wasn’t as dramatic as the CPI saga, but still enough to nudge rates to a slightly higher 2-month peak and keep 2024’s trend of “upwards and onwards” intact.

(If you’re scratching your head wondering why two lines in the chart are social distancing, check out last week’s newsletter for some juicy details.)

Let’s be clear, the 2024 trend of hiking rates was going strong with or without PPI’s input. It didn’t turn the tide but certainly didn’t help calm the waters either. Peeking at the bond market’s reaction to each report gives us the tea: both the moves and the volume of trading spill the beans.

PPI might not be the villain of the story, but it’s definitely not helping speed up any “rate reckoning.” The silver lining? The market had hope that CPI was just a one-off bad apple in an otherwise decent bunch. But with both reports singing the same tune, it’s got everyone wondering if we’re really on the right track with inflation.

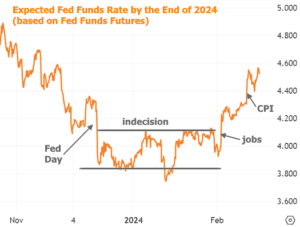

Had CPI and PPI come out better than expected, the Fed might have been inching closer to a “let’s lower rates” party in March, especially if the March CPI report plays nice. But, alas, this week’s reports were like hitting the reset button, making the Fed think twice before popping the champagne.

And let’s not forget about the rest of the economy, which has its own drama. Just a fortnight ago, the big jobs report came out swinging, with job creation on a sugar high, much faster than anticipated. Like CPI, this could be a one-hit wonder or a sign of more surprises to come. This and CPI together have nudged the Fed’s rate expectations from a lazy river to a whitewater rapids adventure.

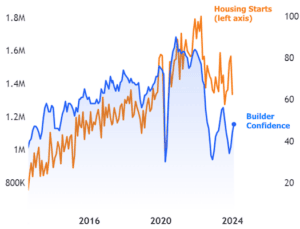

On the housing front, the news was as mixed as a bag of nuts. January saw new residential construction not living up to the hype, falling short of forecasts. Yet, the folks building these houses seemed to be in high spirits, according to the Housing Market Index by the National Association of Homebuilders (NAHB). Maybe they know something we don’t, or perhaps it’s just a case of looking on the bright side while the numbers tell a different story.

Next week, markets are taking a breather for Presidents Day, but keep your eyes peeled for the Minutes from the latest Fed meeting. It’s not a new scene but more like a behind-the-scenes peek at their last gathering. Plus, with multiple Fed speakers on the agenda, we might get a clearer picture of how they’re feeling about the next episode in the jobs/inflation saga. Stay tuned!