Once upon a time, in the land of economic reports and treasury yields, our brave rates embarked on a thrilling adventure to defend their kingdom against the dreaded Ceiling Monster. This week, unlike its dull predecessor, was packed with action and intrigue, starring important economic scrolls and prophecies that helped our heroes in their quest.

Our tale unfolds with the 10-year Treasury yields, the knights of the realm, witnessing their most valiant battles on Thursday and Friday, where they fought valiantly to keep the peace.

As dawn broke at the start of the week, the marketplace was abuzz with anticipation for Thursday’s inflation data. Some wise sages declared the as-expected results a victory, for it did not provoke the Ceiling Monster, keeping it at bay for another day. Yet, other scrolls of data whispered secrets too, like the tome of weekly jobless claims that spoke of “continued claims” reaching heights unseen in over two years.

To understand this, imagine saying “the second-highest since the last dragon attack,” because, like dragons, this unemployment spell doesn’t flip-flop willy-nilly. The realm faced more uncertainty than usual, with omens hinting at possible relief, but this week’s spike was a stark reminder that when the winds of change blow, they can turn into a hurricane in no time (even if “no time” translates to months or years in the common tongue).

The scrolls of history reveal a longer saga of continued claims, showing moments of hesitation before sudden surges, like a prelude to a storm. But, due to the fog of the covid curse, it’s hard to pinpoint when this dance of doubt first began. The most valuable pearl of wisdom to glean from this tale is that the next recession could be a distant shore, far beyond what many adventurers might expect.

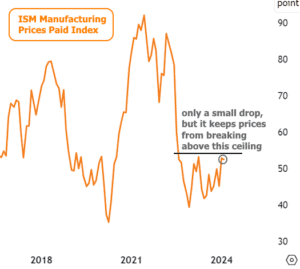

On Friday, the manufacturing data performed a melancholic ballad, with the esteemed ISM Manufacturing index not hitting the high notes as forecasted. While familiar with this tune over the past year, the market’s reaction was spurred by different beats, mainly because the index chose to dive rather than soar, dodging a breakout performance that might have signaled economic revival.

The tale grows deeper with other characters in the ISM saga suggesting a cooler climate ahead for inflation and employment, at least within the manufacturing guild. The “prices paid” chorus also opted not to reach for the high notes, staying within their comfortable range.

When economic indicators and inflation spells avoid challenging the Ceiling Monster, it tempts interest rates to explore the dungeons below, seeking to breach through floors rather than ceilings. Such explorations were hinted at, unveiling a longer view of the 10-year Treasury yields’ journey, showcasing Friday’s daring escape from the sideways limbo.

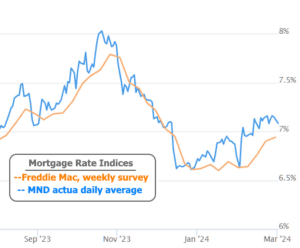

In this world, when Treasury yields bow, mortgage rates follow suit, mimicking their descent. This week was no exception, though the average lender hadn’t quite escaped the shadow of the past fortnight’s lows. Beware of minstrels and town criers touting tales of higher rates, for they may be singing from outdated scrolls.

Verily, this week’s economic data and rate reactions were but a prelude to the epic saga awaiting in the weeks to come. The next chapter teases with scrolls of great impact, especially the anticipated jobs report and the forthcoming Consumer Price Index (CPI) prophecy. Should these new tales weave a different narrative, rates might rally their forces, ready to challenge the Ceiling Monster once more.

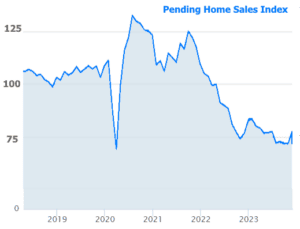

Yet, should the labor market show signs of weariness and the pressure of prices retreat, the realm of rates will continue to exhale in relief, a sentiment echoed in this week’s endeavors. For the domain of housing, such a turn of events couldn’t arrive soon enough. While many forces conspire to hinder the quest for homebuying, the boon of lower rates would be a welcomed ally. This need is echoed in the lament of this week’s Pending Home Sales index, which finds itself wandering near the valleys of its long-term lows.

And so, our tale concludes with our heroes standing at the edge of tomorrow, gazing into the horizon, ready for the next chapter of high stakes and daring deeds in the quest to tame the tumultuous tides of rates and markets.