Ah, the week that was – or wasn’t, depending on how you look at it. With Monday giving us a break from the market’s hustle thanks to a holiday, and the economic news front quieter than a mime’s convention, you’d think it was time for interest rates and the housing market to take a little nap. But oh, they teased us with hints of excitement.

Imagine the bond market, usually buzzing with its own drama, instead sitting back with popcorn, watching European bonds for a hint of what to do next. Specifically, it was all eyes on Germany’s 10yr yield, which, if it were a movie, might not win an Oscar but definitely had its moments.

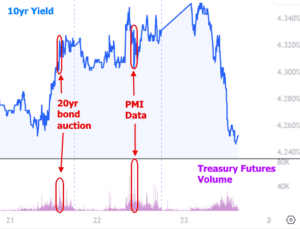

Domestic drama? Sure, there was a bit. But it was like watching paint dry – if that paint was influenced by the excitement of Wednesday’s 20yr bond auction and the S&P PMI data on Thursday morning. Spoiler alert: not much happened. It was the financial equivalent of a stalemate in chess; lots of staring, not much moving.

And yet, in the grand scheme of things, bond yields – those sneaky indicators that decide if your mortgage is going to cost you an arm, a leg, or just a pinky toe – managed to just barely dodge the bullet. They stayed below the dreaded 4.32% ceiling, a number we’ve visited more often than that one relative who always has cake.

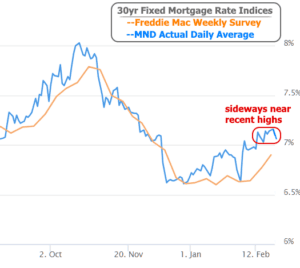

Mortgage rates, in their infinite wisdom, decided to mirror this epic standoff, staying in a holding pattern that would make a pilot proud, all while giving weekly indices the side-eye for their tardiness in reflecting what’s really going on.

In the midst of this, the Federal Reserve’s rate-setting committee members were like, “One month of wild employment/inflation data? Meh.” It’s not that they’re dismissing it entirely, but they’re not ready to write home about it either. It’s a bit like saying, “We see your drama, February, but we’re not going to let it ruin our March plans.”

Then there’s the housing market, strutting in with some swagger because, guess what? January saw mortgage rates hit a 7-month low, and existing home sales got a caffeine boost, zipping around at their fastest pace in nearly a year. And yes, the annual pace of sales decided to show off, climbing back over 4 million, like it’s no big deal.

Looking ahead, it’s like the housing market is saying, “You ain’t seen nothing yet,” with new home sales data and home price indices on the horizon. And let’s not forget about Thursday’s Pending Home Sales, which is pretty much the market’s way of dropping hints about what’s coming next.

As for other economic reports, they’re lurking around the corner, ready to jump out and surprise us – or not. The PCE inflation data is up, trying to steal the spotlight from CPI data, but really, the market’s just waiting to see if it can deliver some cooler inflation vibes. If it does, it could be the nudge rates need to chill out a bit. But the real popcorn moment will be the next jobs report and CPI in early March, ready to either soothe or stir up the market’s drama.

So, as we wrap up this quiet week with its subtle hints of excitement, it’s clear the market is like that one friend who promises a low-key night out but ends up making it an adventure. Here’s to seeing what next week brings – hopefully, more cake.