Last week, we gave you a heads-up: “Keep your eyes on Friday’s jobs report. That thing moves mortgage rates like Beyoncé moves a stadium crowd.” And wouldn’t you know it? Friday brought the house down.

Now, to be fair, the rest of the week didn’t exactly snooze. Monday through Thursday had some exciting guests on the economic stage. We had the Fed’s midweek mic drop, the ever-sassy PCE inflation numbers on Thursday, and even a sneak peek at Q2 GDP. But despite all the headlines, mortgage rates barely blinked. It was like watching a suspense movie with no jump scares.

Then came Friday… and everything changed. The star of the show, officially known as the nonfarm payrolls report, hit the stage and… flopped. The economy only added 73,000 jobs when the forecast was 110,000. Not a complete disaster, but definitely not the performance the crowd was hoping for.

But wait! There’s more.

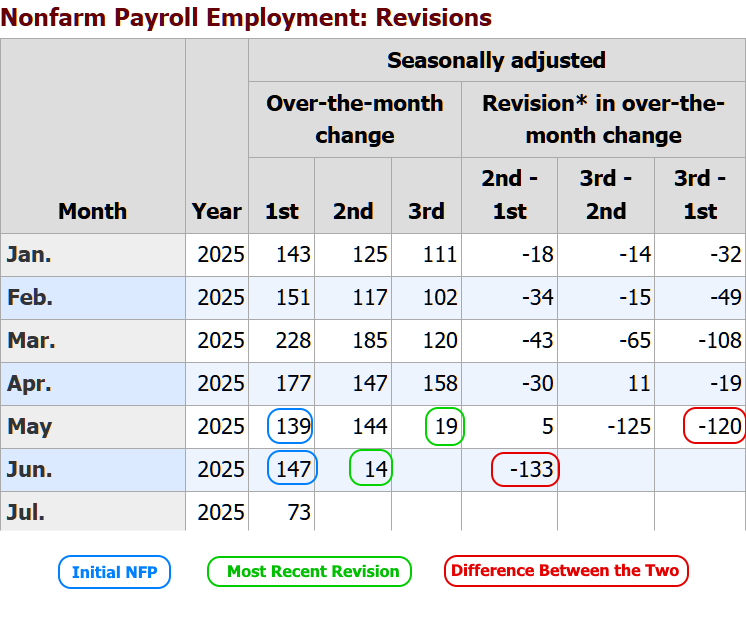

The real plot twist came in the revisions. See, every month the Bureau of Labor Statistics (BLS) updates the job numbers for the two previous months as more data rolls in—kind of like realizing after the fact that your dinner party headcount was off by a few hundred thousand guests.

And these weren’t just little tweaks. The revisions sliced a massive 253,000 jobs off the books. That’s not a typo. Two hundred and fifty-three thousand fewer jobs than we thought. Suddenly, the recent labor market looks a lot less like a treadmill and a lot more like a nap.

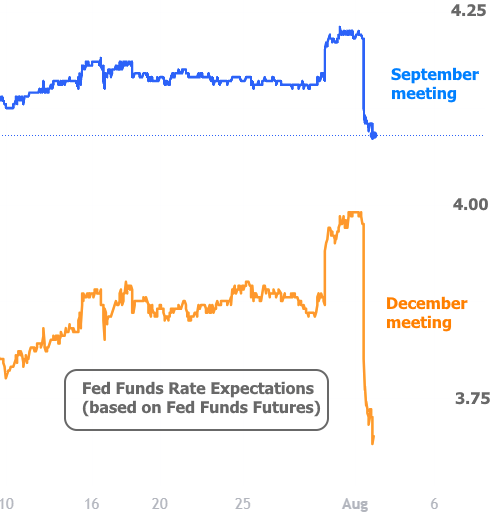

So why should mortgage folks care? Because when the labor market slows down, investors get nervous and start piling into bonds like it’s a Black Friday sale. More bond buying = lower yields = lower mortgage rates. It also gets the Fed thinking, “Maybe we should cut rates sooner than later.”

Now, mortgage rates aren’t directly chained to the Fed’s rate, but they do follow the market’s expectations of what the Fed might do. Think of it like anticipating a plot twist in your favorite series—the vibes matter. And on Friday, those vibes screamed “rate cuts incoming.”

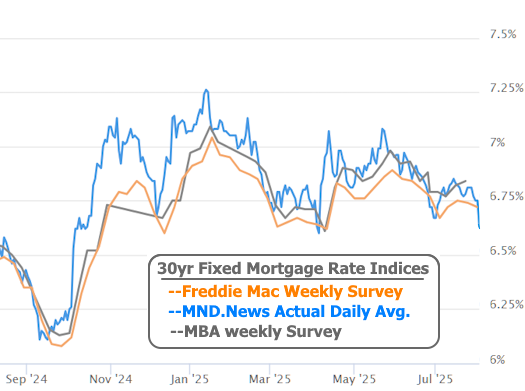

Mortgage rates got the memo fast. By Friday afternoon, many lenders were quoting their lowest rates since early April—and some got so excited they even issued mid-day improvements.

By close of business, the average 30-year fixed rate dropped about 0.125%, putting us within a handshake of the best levels we’ve seen since October 2024.

So, moral of the story? Always watch the jobs report. And maybe keep a party hat on standby just in case rates decide to celebrate.