It’s not often you hear, “Oh, Canada!” when discussing pivotal market movers. However, this week, the typically unassuming Bank of Canada (BOC) took center stage, rattling the financial world with an unexpected policy announcement. This move led to a reconsideration of the U.S. Federal Reserve’s interest rate outlook.

Against the odds, the BOC boldly increased rates. This caught many off-guard as nearly half the market was confident that rates would remain unchanged. It brings to mind a poker game where everyone’s bluffed into folding, and the audacious player with the mediocre hand cleans up. Now, there are whispers that central banks could go the way of “tough love” rather than banking on a drop in inflation. What’s next, we wonder? Fed Chair Powell in a superhero cape declaring, “Tough love, it is!”

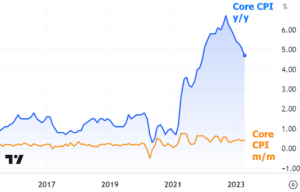

When we explore the year-on-year inflation metrics, it’s evident that inflation seems to be slowing down. The following chart gives us a look at the Consumer Price Index (CPI), both on a monthly and annual scale, at the “core” level, which conveniently omits the more erratic food and energy prices. Core CPI, being the bellwether of inflation data pertinent to rates, will be released next Tuesday, right before the Fed’s announcement on the possible rate hike.

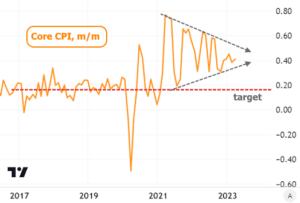

Zooming in on the month-by-month data, the narrative takes a slightly different tone. Inflation continues to exceed target levels, seeming as indecisive as a teenager trying to choose a college major.

This inflation drama is the cause for the schism in opinions on the Fed’s next course of action. It might be more fitting to view this uncertainty through the lens of the future path of the Fed Funds Rate. While the Fed is highly unlikely to hike next week (unless CPI is behaving like a bull in a china shop), traders have been busily recalibrating their expectations of where the Fed will land by year-end. Barely a month ago, the futures market was betting on a full point of rate cuts by December. As of this Friday, the sentiment has done a 180, with the same metrics indicating the Fed might just sit on its hands regarding rate cuts for the rest of 2023.

Now, the shift seen in the blue line of the graph predates any Canadian news this week. It’s as if the bond market was enjoying a lazy Sunday, aware that a hectic week lay ahead. The BOC’s rate hike indeed stirred the market temporarily, but then the uptick in Jobless Claims data brought yields crashing back down the next day. The ensuing chart showcases these events, among others, that have played a key role in shaping rates, starting with last Friday’s jobs report. And for clarification, Jobless Claims and the “jobs report” are two separate things, much like pancakes and waffles—they’re similar but not the same, and they don’t always agree.

At this juncture, one can’t help but ponder how much the Fed Funds Rate truly matters. Especially considering the speed at which the Fed has been raising it—faster than a cheetah on a sugar rush! There’s a general correlation with mortgage rates, yet there are multiple instances where longer-term rates have defiantly moved in the opposite direction from the Fed. Things can get particularly tricky when the Fed is wrapping up its hike party. Notice the plunge in mortgage rates when the Fed Funds Rate last encountered a plateau similar to the one currently being projected.

Next week will not only bring us the verdict on the rate hike (or the “pause” button), but also the quarterly release of the Fed members’ rate forecast for the coming years. While we’re not asking for a fortune teller’s predictions, these forecasts do shed light on the Fed’s strategic moves—be it hikes, pauses, or cuts—in the future. To round things off, Fed Chair Powell will conduct his usual press conference 30 minutes post the 2pm ET announcement of the rate decision and the fresh forecasts. And all of this unfolds on Wednesday, with the previous day serving up the hotly awaited CPI data at 8:30am ET. Get ready for a rollercoaster week, folks!