Ahoy, housing market adventurers! Welcome to the roller coaster world of mortgages and home sales, where the ups and downs are more thrilling than your average theme park ride. Let’s dive into this week’s highlights, where we’ve got some juicy news that’s not quite as zesty as a hot gossip column, but hey, it’s real estate!

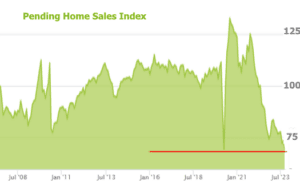

First up, let’s chat about the headline-grabbing, eyebrow-raising “record low” pending home sales. Spooky, right? Well, not so fast. Before you pack your bags and move to a cabin in the woods, consider this: the market is just doing its moody dance, like a teenager who can’t decide what they want for dinner. Yes, sales are down due to some pesky high rates and a shy inventory, but it’s not the end of the world. The “record” low is actually not as low as we thought (plot twist!), and it’s pretty much following the trend. So, don’t worry, be happy!

Now, let’s talk about pending sales. Picture a calm sea before the storm of COVID, when everyone wanted a piece of the housing pie. Then, kaboom! Prices and rates shot up, and sellers played hard to get. It’s a different scene from the Great Financial Crisis, where houses were like items on a clearance sale. Expect sales to bounce back once rates chill out a bit.

Onto the conforming loan limits! Picture this: the government releases some home price data, and just like magic, the conforming loan limit (CLL) gets a boost. It’s like getting a higher credit limit on your card, but for houses. The CLL is the maximum amount our pals Fannie Mae and Freddie Mac will vouch for. It’s not the stuff of headlines, but it’s good news if you were just a smidge over the previous limit. This year, the CLL went from $726,200 to $766,550. Cha-ching!

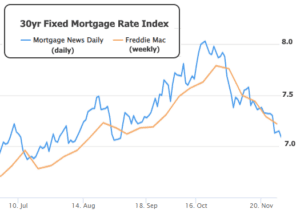

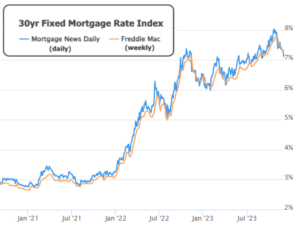

Finally, let’s gab about rates hitting a 3-month low. Now, this is where it gets interesting. It’s like finding a rare Pokémon in the wild. In the grand scheme, this could be the start of a trend reversal, or it could be just a blip on the radar. Analysts are being all mysterious, hinting at a potential rate reversal, but remember, predicting rates is like trying to guess the next plot twist in a soap opera.

In conclusion, the housing market’s got its ups and downs, but it’s all part of the exciting journey. Keep an eye on those economic reports, especially the Jobs Report. If the data plays nice, rates might dip lower. But if it flexes its muscles, we might be looking at more rate hikes. So, buckle up, keep your arms and legs inside the ride at all times, and enjoy the wild ride of the housing market!