In the past couple of months, the rumor mill’s been working overtime, churning out juicy gossips about the Federal Reserve’s rate cuts in 2024. The much-awaited Fed meeting next week is like the season finale everyone’s been waiting for.

Some financial fortune-tellers hinted at a possible rate cut as soon as January. Imagine that! Could it really happen, and what would the hoopla be about rate cuts anyway?

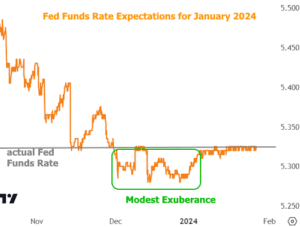

Well, first things first, the market’s like that skeptical friend who doesn’t buy into rumors easily. There was a brief moment when some traders played with the idea of a January rate cut, but that ship has sailed.

The market did a little dance in November and December, reacting to a hint from the Fed that they might be feeling generous with rate cuts. But since then, the economic data hasn’t been waving pom-poms for a rate cut party. It’s not a “no” for 2024, but more of a “let’s not get ahead of ourselves.”

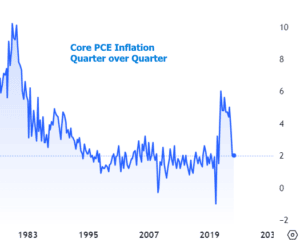

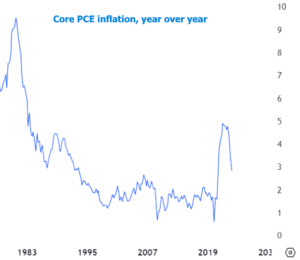

But hey, core inflation did hit the 2% sweet spot, matching the Fed’s target. This week’s GDP data showed core PCE at 2% for the quarter.

Don’t get too excited, though. That 2% is an annual thing, not a quarterly special. Sure, the last quarter of 2023 looked promising, but now we need to see if this 2% is here to stay for the annual party.

The Fed’s also got an eye on the job market, hoping for a bit more wiggle room there. If the economy’s too peppy, they worry inflation might get a second wind. Next week’s job report is like the next episode in this economic drama, but there are other data releases before the Fed’s big announcement too. Job Openings and the Employment Cost Index are the opening acts, but it’s really the Job Openings that’s been stealing the show lately.

So, what’s the real power of the Fed here? Since their last meeting, there’s been no major plot twist in the data, and there’s no new forecast chart for them to doodle on. The market might just end up as confused as before.

But don’t worry, the interest rate rollercoaster hasn’t gone off the rails. It’s more like it took a breather after the exciting ride at the end of 2023. Traders are now waiting in the queue, popcorn in hand, for data that would either push for a sequel or a genre switch to higher rates.

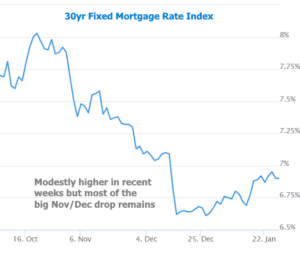

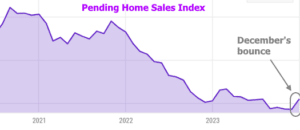

In the housing market, things aren’t looking “too strong” for the Fed. December’s pending home sales were a bit more upbeat than November’s, which is a nice change, but they’re still hanging out near the bottom of the chart.

Yet, this is a great showcase of how lower interest rates can jazz up sales. And there’s still room for the new construction sector to strut its stuff. Even though new home sales dipped a bit, they’re doing a decent job compared to the long-term scene.

So, as we eagerly wait for the next episode in the Fed’s rate-cut saga, remember, in the world of economics, it’s always a mix of suspense, drama, and a little bit of humor. Stay tuned!