Alright, let’s add a dash of humor and lightness to this blog post while keeping its essence intact:

“Hold onto your hats, folks, because the rollercoaster of interest rates has taken a surprising dip recently, leaving everyone scratching their heads. But fear not! We’ve got a chart that will make everything as clear as a summer sky.

Now, the Federal Reserve might not be the puppet master of rate levels, but let’s just say they’ve got their hands on the strings. They’ve been getting pats on the back for the past couple of months of improvements. But remember, they can’t take all the credit – the economic data had to nod in agreement first.

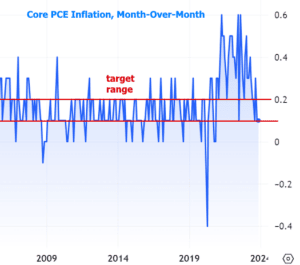

Inflation is pretty much the star of the Fed’s job description. But before we unveil the chart to end all charts, let’s peek at one that might make you go, ‘Huh?’ We often hear that Core year-over-year PCE is the Fed’s go-to for keeping an eye on their 2% inflation target. Here’s the latest look:

If this was our only inflation window, the Fed would be sitting on their hands instead of cutting rates. But wait, they’re not actually cutting rates. They’re more like those folks who plan a vacation they might never take, talking about what they’d do if that line keeps dropping.

Some naysayers think it’s premature to even chat about rate cuts. But here’s the twist: the year-over-year inflation figures are like old family photos – not really showing what’s happening now. Good thing we’ve got month-over-month charts to spill the real tea.

These monthly figures are already hitting the bullseye on the target. Even the last six months of core PCE data would high-five the 2.0% target. The gist is, unless inflation decides to sprint upwards, the yearly figures will mosey on down to where they should be.

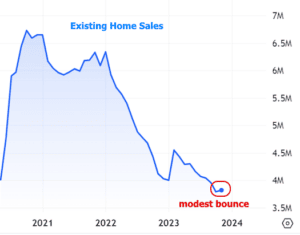

Mix all this with the Fed’s dream of a ‘soft landing’ for the economy, and you can’t really argue against them just pondering over rate cuts for 2024. Some sectors are already sending ‘thank you’ notes for a gentler interest rate scene. This week’s reports are like gossip magazines for the economy, filled with juicy details.

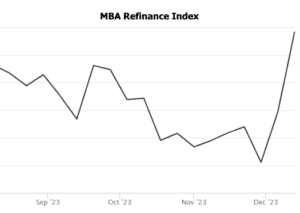

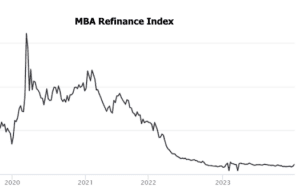

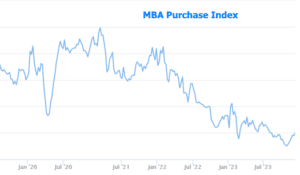

So, will the housing market do a happy dance with lower rates? The Mortgage Bankers Association’s weekly tea leaves – I mean, data – seem to think so. Both purchase and refi applications are partying like it’s the highest they’ve been in months.

For a broader picture, let’s play detective and examine these metrics in a wider scope.

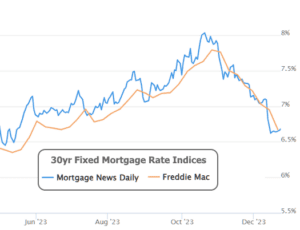

Market-wise, this week was as exciting as watching paint dry. Mortgage rates were as steady as a cat napping in the sun, cozying up to the lowest levels in seven months. The Mortgage News Daily Index and Freddie Mac’s weekly rate index are like two peas in a pod.