Ah, 2024, you sneaky year! You’ve managed to flip the script on us since the grand finale of 2023. Remember those days in November and December when mortgage rates decided to play limbo and see how low they could go? Well, January has swaggered in with a different tune, lifting rates to a “haven’t-seen-these-numbers-in-a-month” high note.

Now, let’s clear the air about those pesky rumors claiming rates hit rock bottom this week. Spoiler alert: they didn’t. The rumor mill might have been less off-base last week, but still, it’s like saying I almost won the lottery—I was only six numbers off!

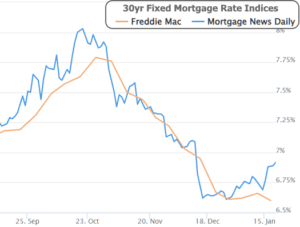

The confusion culprit? None other than Freddie Mac’s weekly survey, the mortgage rate world’s equivalent of a wise, old owl. However, even wise owls can be a bit behind the times. The issue is that Freddie’s survey takes a leisurely stroll from Thursday to Wednesday and then tells us about it a day later. So, when the 11th and 12th were strutting their low-rate stuff, Freddie nodded in approval. But then the rates spiked on the following Thursday and Friday, and Freddie missed the party because the survey was already done.

Here’s a snapshot comparing Freddie’s chill survey rate with the MND daily index, which is more like your on-the-ball, coffee-fueled coworker. Remember, it’s all about the rhythm of the lines on this chart, not just the numbers.

So, what’s the bottom line? Rates are strutting on a high-wire, the highest in over a month, believe it or not!

But hey, every cloud has a silver lining. Rates are still doing a victory dance, being more than a percent lower than their October peak. The bond market’s just taking a breather after sprinting at the end of last year. So far, it’s been a gentle jog, not a mad dash.

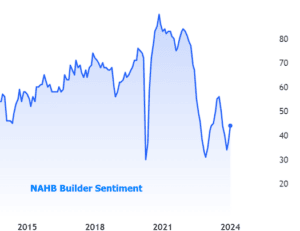

In housing news, new homes and construction are basking in the spotlight. The NAHB shared some good vibes with a nice bump in builder sentiment.

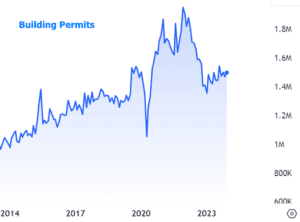

And the steady drumbeat continues with December’s building permit data, showing that construction and new homes are still the cool kids in the housing market neighborhood.

Then there’s the plot twist: Existing Home Sales in December were at their lowest since the days of 2010’s trendy tunes.

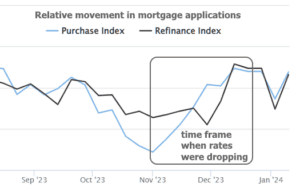

On a brighter note, the housing market seems to be warming up to the recent rate improvements. Just peek at those mortgage applications; both refinancing and new purchases are back in the game.

Looking ahead, the housing market’s next episodes feature New Home Sales on Thursday and Pending Home Sales on Friday. Fun for housing market enthusiasts, but not the headline act for the Fed’s rate-setting show. The next big Fed announcement isn’t until January 31st, and until then, we’re all just sitting on the edge of our seats waiting for the next twist in the rate rollercoaster.

So, here’s the thing about 2024’s rate predictions: keep hope in one hand and reality in the other. Yes, we’ve seen a great comeback since October, but remember, it’s like bouncing back from a high dive—it looks more impressive because of the height! Sure, rates might take a scenic route downwards this year, but only if economic growth and inflation don’t decide to crash the party. It’s an old tune, but it still plays: the rate journey is all about following the data breadcrumbs. And if it feels like we’re all just waiting for the next big data reveal, well, that’s because we are!