Grab your popcorn and cozy blanket, financial enthusiasts, because today we’re diving into the edge-of-your-seat thriller that is…government shutdowns! 🍿💸

Now, flicking through the news lately is like being on a never-ending rollercoaster ride of government decisions and “to be or not to be” shutdown dialogues. As of our latest episode (or, ahem, Friday afternoon), the great government halt is looking pretty darn likely to make an appearance. But fear not, because we’re skipping the political drama and jumping straight into a whirlwind romance with housing and mortgage markets and how they fare amidst all this.

First things first, let’s bust out our crystal balls! 🔮 Predicting a shutdown’s impact on various sectors is, well, akin to predicting next week’s lotto numbers – we’re kinda light on the hard evidence. With a mere duo of examples of extended shutdowns in this thrilling century of ours, let’s squint at them through the lens of that beloved cinematic classic, the 10yr Treasury yield.

Imagine this: yields hitting those long-term highs then gracefully swan diving back down. Ah, the grace! The 2013 shutdown swaggered in, obstructing that elegant descent, while the 2018/19 shutdown seemingly hit the fast-forward button. Snip out those red drama-filled sections, and lo and behold, the grand narrative doesn’t look all that different.

One might boldly say – if there’s a thesis to be etched into the annals of shutdown impact lore, it is this: in the grand, cinematic sweep of things, they might just be a mere subplot, especially for our beloved rates. It seems a bit hasty, sure, but hear us out while we ponder:

- Our charts? Opposite impact in each scene.

- The 2018 sequel? Aired during that oddball festive season known for its wacky market plots.

- Popular theories? They contradict faster than a soap opera plot twist.

Theory Popcorn Bucket 1: economic uncertainty for consumers, thwarted growth, yada yada. In essence, a shutdown tells economic activity to take a backseat, since those government employees need to count their pennies, waiting for paychecks. No spendy, spendy equals slower economy, theoretically giving a nudge to lower rates.

Theory Popcorn Bucket 2: This one’s a bit of a brain teaser. Economic uncertainty, again, but this time for investors. Our woes about slower economic growth are tempered by factors that seem to push rates into higher echelons. And despite lost revenue that’s often recouped through increased Treasury borrowing (hello, higher rates), this dynamic might take its sweet time to unfold, potentially being offset by nuggets from theory 1.

Fast-forward to government mortgage loans. 🏡 Brace for a few head-scratching moments and possible delays in processing some FHA/VA/USDA loans, but for now, our insiders tell us the core features of these governmental housing programs will keep rolling.

The plot twist for financial markets and rates: UNCERTAINTY!

Despite the shutdown stealing the spotlight, rates and markets have other influential directors calling the shots. But with the shutdown turning the volume down on motivations, it’s like our favorite economic reports (think the blockbuster hits like the CPI and the Employment Situation) have been left on read.

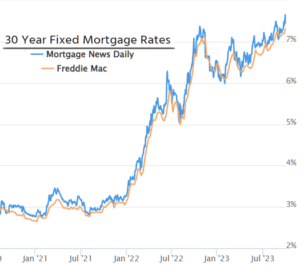

Such reports, which were scheduled for a grand release, won’t see the light of day during a shutdown, and the data collection for future releases might get a bit, well, sketchy. It’s a cliffhanger for rates, especially when they’ve just been soaring thanks to hardy economic data.

Even though some reports will still grace our screens, with no reliance on government data, whether they’re a savior or a scoundrel depends on the outcomes. If these lone rangers suggest strength or resilience, rates might feel the upward pressure and leave us on another nail-biting season finale.

And so, the saga continues… Will the rates climb? Will the reports provide salvation? Find out on the next episode of “Government Shutdown Chronicles!” 🎥🍿📈