Roll up, roll up! Gather ’round, financial aficionados, and listen to the tale of this week’s Fed shenanigans. 🎩📈

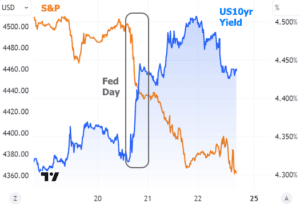

So, let’s set the stage: The Fed had their little meeting (as they do 8 times a year, for those not in the know). And, drumroll, please… they held their policy rate unchanged! But, in a plot twist straight out of a daytime soap opera, almost every other interest rate in the US shot up like my caffeine levels on a Monday morning.

If you’re scratching your head wondering why, don’t worry. This kind of twist happens quite a few times throughout the year. Even when the Fed’s all, “Let’s hike the rates!” sometimes rates drop. It’s like when you order diet cola but get the regular one instead. There are many mysterious reasons for this, but I’ll just spill the beans on two of them.

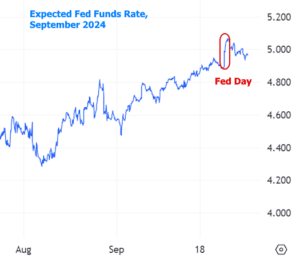

Numero Uno: The Fed has its 8 little meetings a year, while the bond market? Oh, honey, it’s living its best life, updating thousands of times a day! So, when the Fed makes its move, it’s often just catching up to the gossip the market’s been dishing out for ages.

How do they avoid springing surprises on the market? Through riveting speeches and press conferences! It’s like sending a “heads up” text to your friend before you drop by.

Traders, being the savvy folk they are, bet on these rate changes through Fed Funds Futures. And guess what? They haven’t flinched in their expectations for a while, predicting a 5.375% Fed Funds Rate. And here I thought my bingo nights were thrilling.

So, when the Fed kept rates steady, it was basically like revealing the end of a movie everyone had already seen. We can nix the rate decision as the main character for this episode and search for a new protagonist.

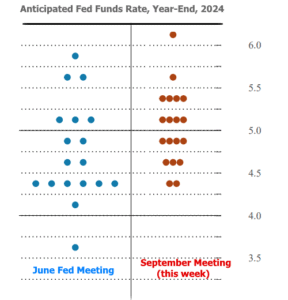

Twice a year, in sync with the Fed Funds Rate decision, the Fed pulls a rabbit out of its hat: the “summary of economic projections.” Inside this magical document? A dot plot (not to be mistaken with a polka-dot plot). These “dots” have turned into the celebrities of the financial world, even though the Fed Chair politely asked everyone to not go fan-crazy over them.

The market doesn’t obsess over these dots because they have a crystal ball. Nope. They just give the juiciest updates on the Fed’s thoughts. Imagine the dots gossiping about the Fed’s future moves.

The market thought the dots would get a little more glamorous, but they went full Hollywood on us. Stocks and bonds? Not fans of this new look.

Recent news hinted at a “higher for longer” vibe for the Fed Funds rate. This week’s news didn’t totally change the plot but did add a spicy twist. The market’s predictions for September 2024? They’re a rollercoaster!

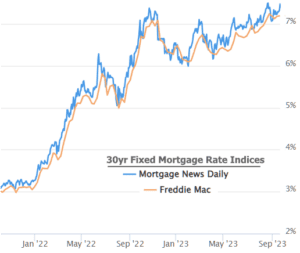

Our latest episode saw rates almost reaching the peaks of drama. But, they just missed setting a new record – by the slimmest of margins. Let’s tune in next week, as Freddie’s numbers might just make history!

Why’s this soap opera unfolding? The Fed Funds Rate is essentially wielding a sledgehammer trying to fight inflation. Prices have cooled down, but there’s still steam. With drama from fuel prices, car industry tiffs, and medical bill recalculations, it’s a wild world. Some argue the Fed’s been binge-watching too much and should just chill. Others believe the plot should thicken. But all eyes are on the upcoming cliffhanger episodes in early October. If the story takes a dark turn, rates might ease up. If it’s all rainbows and sunshine, rates will continue their ascent. Grab your popcorn, folks! 🍿📉📈