So, the much-awaited Consumer Price Index (CPI) report dropped this week, and let’s just say it was kind of like expecting a blockbuster movie but getting a decent indie flick instead. For those who were hoping inflation would do a magic trick and disappear back to the Fed’s target level, well, it wasn’t the grand spectacle they’d hoped for. But hey, on the bright side, rates did a little shimmy and moved lower!

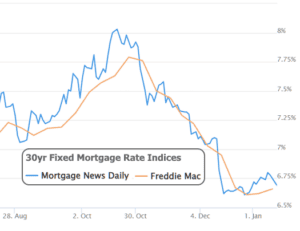

Now, let’s talk about mortgage rates and most other rates. They’re like puppets dancing to the tunes of the bond market. When inflation acts like a rock star, bond yields and rates are the front-row fans going wild. The market’s been playing the waiting game for signs of lower inflation, like a crowd waiting for the encore that lets interest rates mellow out.

Enter the CPI, the Beyoncé of monthly inflation reports. It’s been the talk of the town, causing a stir in rates more times than we can count. Recently, it’s been whispering sweet nothings about a possible return to those cozy, lower inflation levels, which would be music to our ears for lower rates.

But hold your horses! The CPI has been a bit of a tease in the past, giving us false hope, so traders are playing it cool. This week’s report was like getting a “maybe” to a date invite – not a solid yes, but hey, not a ghosting either.

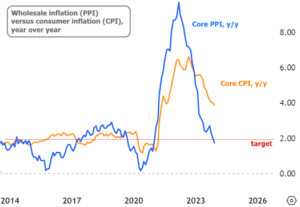

In response, rates were like, “Eh, we’ll just chill here for now.” They didn’t really jump around much after the CPI show. But then, the next day’s Producer Price Index (PPI) came out, wearing a superhero cape, showing better signs of calmer inflation. Both CPI and PPI have been on the down-low, but PPI is now back to being the teacher’s pet, hitting target levels.

Next, let’s look at a chart about as exciting as watching paint dry – it shows how 10-year Treasury yields (which are BFFs with mortgage rate movement) reacted during the week:

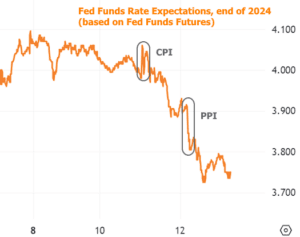

Notice the initial “Yikes!” reaction to CPI. But then, like a plot twist in a soap opera, there was a recovery later that afternoon. Why, you ask? Well, one of the reasons could be rumors that the Fed is gearing up for a rate cut party this year and tweaking how it handles its bond portfolio. When we peek at the actual Fed Funds Rate expectations, they’re lower than a limbo stick in July.

Now, mortgage rates and Fed Funds Rate expectations don’t always move in sync (kind of like trying to dance with someone who has no rhythm). So, while they’re not doing the limbo under recent lows, they haven’t climbed any mountains either. This week’s rates took a gentle slide, like they’re trying not to spill their coffee, holding onto most of the gains from Nov/Dec.

Looking ahead, next week might not have the star power of CPI, but Wednesday’s Retail Sales report could still cause a stir. It’s expected to show a bit of pep, going from 0.3% to 0.4% month over month.

And in the world of the Fed, it’s gossip central! We’re all ears for what several Fed speakers, especially Waller at the Brookings Institute, have to say about the secret recipe for rate-friendly policies in 2024. This tea party happens on Tuesday, the first business day after we pay tribute to Martin Luther King Jr.

While they might not steal the spotlight, updates on housing metrics like new home construction, builder confidence, and Existing Home Sales are

also in the mix. Think of them as the supporting actors in our rate drama – not the main stars, but still pretty important for setting the scene.

So, there you have it, folks! A week in the exciting world of inflation data and rate movements, with a twist of humor to keep things interesting. Stay tuned for the next episode, where we find out if the rates keep playing it cool or decide to rock out. And remember, in the thrilling world of finance, it’s always best to expect the unexpected – like finding an extra fry at the bottom of your takeout bag!