Alright, let’s dive into the world of finance with a sprinkle of humor and a dash of lightheartedness! Today’s topic: The Curious Case of the Mortgage Rates vs. the 10-Year Treasury Yield. Suddenly, it’s the talk of the town, but really, should it be?

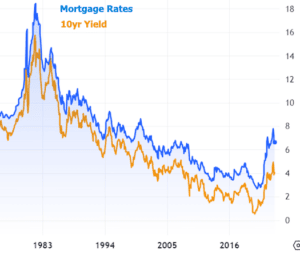

First question on the pop quiz: Why are we even talking about the 10-Year Treasury yield when we’re all about mortgages and housing? Well, it turns out the 10-Year Treasury note is like the high school quarterback of interest rates in the U.S. – everybody wants to be like them! Mortgages and the 10-Year Treasury yield are like two peas in a pod, usually moving together like best buddies. Exhibit A:

You’ll notice that mortgages are like that one friend who always walks a bit faster, but they’re basically keeping up with the 10-Year. So, why is everyone making a fuss?

Both rates are having a bit of a party right now, and it’s not the fun kind. They’re at their highest in a decade, and that’s causing quite a stir in the mortgage world. High rates are like uninvited guests at this party, and everyone’s looking for the exit sign. There’s talk about the blue line (mortgages) getting a bit cozier with the orange line (10-Year Treasury).

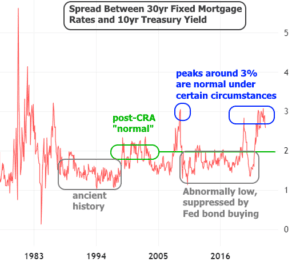

Are they playing hard to get? Kinda! At their most aloof, mortgage rates were playing it cool at more than 3% higher than the 10-Year. But history shows us they once flirted at just 1% apart. Imagine, a 7% mortgage rate could play footsie with 5% – now that’s a love story!

But wait, there’s a twist! Why is the spread wide enough to drive a truck through? Two big reasons:

- The Fed stopped buying bonds (and made a special note about not buying those mortgage-backed bonds).

- Interest rates decided to sprint up to the highest levels in ages.

Each reason on its own could cause a stir, but together, they’re like the dynamic duo of wide spreads since the 80s.

In simpler terms, spreads are wide, and they’re meant to be. Also, using the good ol’ days as a benchmark for “normal” is like trying to fit a VHS tape into a Blu-ray player. Things have changed, folks! Since the mid-90s, the Community Reinvestment Act (CRA) shifted the investor risk scene in mortgages. Before that, the end of the Savings and Loan crisis and the rise of mortgage-backed securities (MBS) created a golden era for mortgage risk sentiment. Ah, the good old days!

When we talk about “natural” spread levels, we mean spreads that haven’t been squished unnaturally low by the Fed’s shopping spree on bonds.

So, what’s the deal with the Fed’s bond buying? That’s a saga for another day. In short, post-2008 financial crisis, the Fed went on a bond-buying binge and struggled to find the right moment to say “enough.” This shopping habit helped keep mortgage rates low. But when they finally decided to cut the credit card, inflation was throwing a wild party, sending interest rates through the roof.

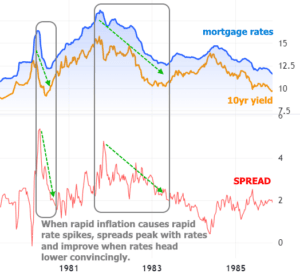

Mortgage investors, like cats, are not fans of sudden movements. So, with the Fed’s “quantitative tightening” (fancy term for “no more bond buying”) happening amid a rapid rate spike, it’s quite a feat that the spread didn’t do a full gymnastics routine!

But how do we get these spreads back to being BFFs? Can the Fed jump back into the bond-buying game? Here’s the frustrating bit: there’s no magic wand to wave here. The Fed is pretty much done with the MBS scene – they’ve seen it, done it, and even got the T-shirt. They’re more likely to stick to Treasuries unless things go really south, like 2008 south.

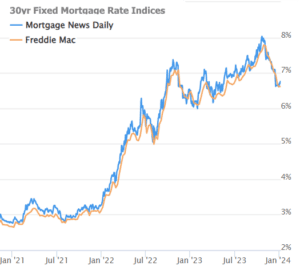

But hey, have you noticed that mortgage rates have sneaked down more than a full percent recently without any grand intervention? It’s like they’re on a self-improvement journey!

In fewer words, yes, things might just sort themselves out. The world of 2024 is not the retro world of the late 80s and early 90s. Spreads as close as 1% might be wishful thinking, but aiming for just under 2%? Totally doable.

Consider this: the early 80s are the only time in recent memory similar to our current inflation and interest rate drama. And what happened then? Spreads peaked with the inflation/rate peaks and began to chill out when rates did. It’s likely the same drama will unfold this time if rates decide to take a breather.

Here’s a brain teaser for spread enthusiasts: If we manage to narrow the spread to 2% and 10-Year yields also drop to 2% for some economy-inflation tango, would you still worry about the spread? In this scenario, a 2% spread could mean 4% mortgage rates – not too shabby, right?

Alright, let’s do a rapid-fire round on this week in the mortgage market. Traders are back from their holidays, leaning slightly towards higher rates, but it’s no biggie. The market is still eyeing the economic data like a hawk. Check out this chart for the week’s highlights:

The impact on mortgage rates? Just a blip on the radar, and for the finale, next week’s headline act: the consumer price index (CPI), dropping Thursday morning. Stay tuned for more financial fun!