Who says 2023’s all smooth sailing? The housing and mortgage markets have seen more turbulence than a budget airline hitting turbulence over the Rockies. One particularly tricky tailwind – our dear old friend, the Federal Reserve.

When you think of the Fed, rate hikes and cuts might pop into your mind faster than that third cup of coffee hits your bloodstream. After all, it’s always on the news, and even makes an appearance at backyard barbecues and water cooler chatter.

Let’s be clear, the Fed Funds Rate (our protagonist in the rate-hiking/cutting drama) is crucial, but its importance is like a secret sauce. You know it’s there, but you can’t exactly tell what’s in it. The perplexity originates from financial markets always acting like the fortunetellers they are, predicting the Fed’s decisions before any of the eight annual rate-setting reunions. This rate-setting soiree seems to happen less frequently than changes in US Treasuries – which might have just fluctuated eight times while you were reading this.

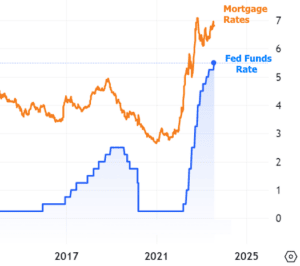

Take last week, for instance, the market was so sure the Fed was going to hike the rate by a quarter of a percent that you’d think it had a crystal ball. Consequently, this hike was baked into the interest rate pie already. This leads us to another exciting truth: Interest rates are like a buffet. They come in different flavours, suited to varied borrowing types. The Fed Funds Rate is just the appetizer, acting as a point of reference for simple, short-term borrowing. But when complexity and longevity join the party, the resemblance to the Fed Funds Rate can become as unclear as the end of ‘Inception’.

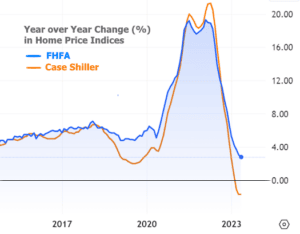

Mortgage rates embody this perfectly. Although over long durations, they might do a merry dance with the Fed Funds Rate, close-ups reveal a scene from ‘Stranger Things’. Mortgage rates can act like rebellious teenagers, going down while the Fed’s hiking, and the opposite.

To understand this, imagine the Fed Funds Rate as your carefree friend who only worries about things for 24 hours, while a mortgage rate is like that friend who overthinks every scenario for the next 30 years.

Now, here’s the twist: mortgage rates may ignore the Fed rate hike initially, like a kid pretending not to hear their bedtime, but they certainly care about what the Fed is going to do next. They are also deeply concerned about the Fed’s overall stance, which helps them foresee the next big move.

During the press conference following a rate hike/cut announcement, we usually gain some insights into the Fed’s mindset. This time, we wondered if Powell would become more flexible, given the recent progress on inflation. Although he did acknowledge the progress, he was quick to remind everyone that the battle against inflation is far from over.

So, Powell walked the tightrope, and rates reacted with a shrug. It was only the next day that the game began to change due to stronger economic data.

Economic data always acts like a nosy neighbour to rates, regardless of what the Fed is up to. At present, it also has the Fed’s attention as they’re on the hunt for signs of economic slowdown that might call for a reconsideration of their inflation-tackling strategies. This is exactly why the Fed confidently went ahead with the rate hike, even though the recent inflation data didn’t necessarily warrant it.

But as long as jobless claims are dropping to February’s low levels, and GDP growth is beating expectations, the Fed can comfortably stick to a ‘higher for longer’ strategy when it comes to the Fed Funds Rate.

Mortgage rates, though, will likely start a downhill journey before the Fed commences its next rate-cutting cycle. Signs for this shift will be found in, you guessed it, economic data. However, it would take a consistent stream of depressing economic news for rates to start a victory dance. In simpler words, for rates to win, the economy must seem to lose.

In the meantime, the housing market will continue wrestling with the challenges of inventory shortage and low buying demand until it can reach pre-pandemic sales levels. The exception here is the New Homes market, which has been flexing its muscles quite a bit recently. The latest report didn’t meet expectations, but the overall trend remains steady, with sales close to pre-covid highs.