Lights, camera, action! Financial markets can be as unpredictable as the plot twist in your favorite soap opera. Sometimes they keep you on the edge of your seat, and sometimes they give you an unexpected twist on a lazy Tuesday morning after a long weekend.

Once upon a Monday, the markets were chilling, taking the day off. But come Tuesday, they woke up with a jolt of caffeine and went on a rollercoaster. Now, you might wonder, “Did we miss an invitation to this financial party? Should we have brought popcorn?” Nope, there wasn’t any VIP warning, just a sneaky puppet master behind the curtain.

Let’s break it down like a dramatic theater troupe for those who nodded off during Economics 101:

- Interest rates? They’re all about the bond life.

- The Fed plays the DJ, setting the beats for the shortest-term bonds, and the market crowd takes it from there.

- Bonds have cliques: US Treasuries (the preps), Mortgage Backed Securities (MBS, the jocks), Municipal Bonds (the student council), and Corporate Bonds (the business club).

- They all have different vibes but belong to the same “fixed income” school club where everyone gets repaid with a bit of interest.

Now that we’re all caught up, let’s get to the juicy part. Tuesday was like a massive sale at your favorite store; it was the 5th biggest bond bonanza ever! We had seen big sales before, but Tuesday was special as the most expensive item was “only” a mere $4.75 billion. Imagine, it’s like every bond suddenly decided to throw a party on the same night!

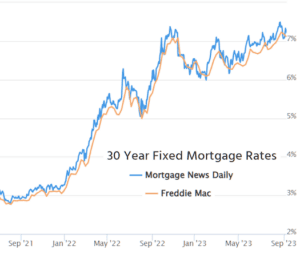

The result? Too many parties, not enough guests. Which means, in the bond universe, lower prices and higher rates.

The week had its share of drama. Some new gossips – er, data – dropped on Wednesday, and spoiler: they weren’t the good kind. The ISM Non-Manufacturing Index spilled some tea, showing the service sector had been eating its greens and growing stronger than we thought.

Apparently, economic health and higher prices play the villains in our little story, making rates soar. It’s like the bad boy of financial soaps, always stirring trouble.

The week’s finale? A calm-before-the-storm episode where the rates had a chill pill. But remember, in every drama, there’s always that ominous scene hinting at a sequel.

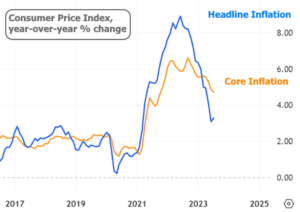

Next week’s episode is titled “The Mysterious Case of the August CPI.” It’s that juicy topic that has everyone gossiping. With fuel prices playing hide-and-seek lately, who knows what’s up its sleeve this time?

And here’s the cliffhanger – it’s the Fed’s “blackout week.” That time of the year when they practice their vow of silence. No comments, no hints. So, the market gets a bit imaginative, like a kid left alone with crayons. Is inflation finally bowing out? Or is it prepping for a dramatic return? The suspense!

So, as we await the next episode, let’s all ponder: Will inflation get a redemption arc or will the Fed’s uncertainty theme continue? Stay tuned!