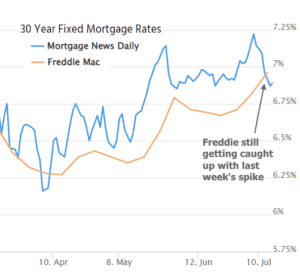

Last week, mortgage rates shot up like a startled cat after a few economic reports suggested the economy was pumping iron harder than expected. But just as quickly as they soared, key inflation data this week showed prices hitting the gym and losing weight, causing rates to stage a full recovery.

If rates had to pick a monster to be scared of in the economic horror movie, it’d be inflation. Here’s why: rates are built on bonds, which promise investors a nice steady stream of cash flow, like a loyal dog bringing in the morning paper. But with time, inflation turns that cash into a skimpy outfit – it just buys less “stuff”. Hence, investors ask for a better deal – higher rates of return – and voila! We have a one-act play on the post-covid rate spike.

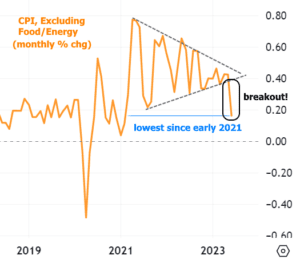

For some time now, the star attraction of the inflation metrics has been narrowing down its focus like a dieting sumo wrestler, yet remained at pumped-up levels. This week, however, we’ve got the breakout moment that low-rate fans have been yearning for. And in a blink, the monthly pace of inflation is as skinny as it was in early 2021.

Year-over-year inflation is looking as fit as a fiddle, too, especially when you sprinkle in energy and food prices (shown by the cool blue line below):

The above chart shows a bit of a pickle for our policy buffs. The Fed is like a gardener, trimming short term rates to keep the economy in check and coax inflation back to a 2% growth rate, like a tomato plant. They’re keeping an eagle eye on core inflation (hello, orange line). But as the chart shows, we’re still a good jog away from that 2%, and we’ll need another year’s worth of good-news reports before we’re back in the tomato-growing zone. So, the Fed’s scratching its head, trying to figure out if the current level of the Fed Funds Rate will be the magic ticket.

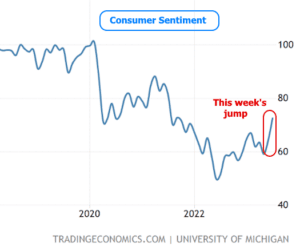

Speaking of which, the market’s betting on the Fed hiking at least once more in 2 weeks, then heavily relying on economic data like a GPS. Peeking into the crystal ball of the market’s expectations for the December Fed meeting, we can see Consumer Sentiment pushing back against CPI like a cranky toddler.

Consumer Sentiment is usually the quiet cousin at the family reunion compared to the loud and boisterous CPI, but this week it’s screaming for attention with a very strong report.

Long term rates, like the studious 10yr Treasury yields, mimicked the Fed’s rate hike outlook this week, but were more engrossed in the inflation data and shrugged off the “hold on a minute” flag raised by the Consumer Sentiment data. Stocks, on the other hand, also kept their eyes glued to CPI (and the possibility of a friendlier Fed, a rising tide that gives a leg up to both stocks and bonds).

Zooming out a bit, yields are in a holding pattern, but have niftily ducked back below the 3.84% level, which had been the ceiling until last week.

Remember last week’s drama with the rate spike? It caused Freddie Mac’s mortgage rate index to vault higher, but don’t panic. Freddie’s just taking the average of the last 5 days. If we peek at the actual daily averages, rates took a plunge during the first four days of the week and managed to tread water on Friday.

Looking ahead, we’re in a bit of a summertime lull next week with none of the massively important economic reports seen over the past 2 weeks. It will also be the “blackout period” for the Fed. That refers to the 12 days leading up to a Fed announcement where Fed speakers abstain from commenting on policy. As such, the market sometimes speculates a bit more than it otherwise would about what the Fed is thinking, but that’s typically a bigger risk when the blackout period coincides with highly consequential data. Either way, this week’s gains are merely a start. It will take several more weeks–if not months–of economic data to conclusively shift rate momentum in a friendly direction.

Featured Image – AFN research and replicate.