Well, folks, buckle up because it’s time for a rollercoaster ride through the wild world of mortgage rates, and trust me, this one’s got more twists and turns than a soap opera. But hey, I promise to sprinkle in a little humor to keep things light!

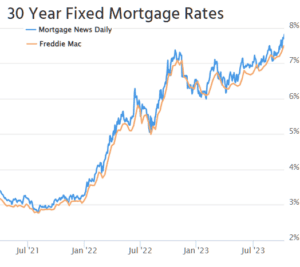

Hold on to your hats, because we’re diving headfirst into the chaos that is the mortgage rate market. As of last Friday, we were cruising along with a 30-year fixed rate just shy of 7.5%. But guess what? As of this Friday, we’re edging closer to the 8% mark. Whoa, Nelly!

Now, I know what you’re thinking. “But some lenders are quoting lower rates, right?” Well, sure, but that often involves some mysterious discount points. You know, the kind that’s like finding a hidden treasure chest in your backyard. The Freddie Mac survey, which is the orange line in those fancy charts above, doesn’t even account for these discount points. And remember, it’s a weekly average, so it hasn’t caught up with the rates from Thursday or Friday yet.

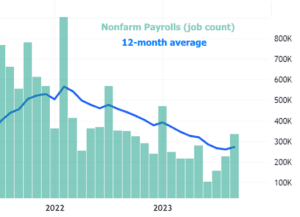

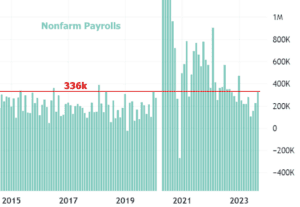

But here’s where things get spicy. Last Friday was like a rollercoaster ride to the highest rates we’ve seen in 23 years! The culprit? The big monthly jobs report dropped like a bombshell, showing job creation soaring way faster than even the smartest economists could predict. It was like a surprise party you didn’t know you were invited to.

And here’s the kicker – this job growth (336k new jobs) is dancing right at the upper edge of the pre-pandemic range. Most economists were shaking their heads, thinking we’d never break above 300k after averaging less than 200k for the past three months. But oh boy, the bond market wasn’t having any of it. Those 10-year Treasury yields (the benchmark of all benchmarks) left no room for doubt – they were heading for the hills.

Now, you might wonder why, after all that panic over the job data, the bond market decided to make a U-turn later in the day. Well, my friends, it’s all about those traders and their Friday afternoon plans. You see, when traders bet on higher rates (which they were doing), they had to close those positions. And when they did, rates eased up a bit. It’s like a game of musical chairs for the finance world!

But don’t let that fool you. The big picture here is all about momentum, baby! After the last Fed day, the market decided it was time to reprice itself for a “higher for longer” rate future.

So, here’s the deal – for rates to really drop, economic data needs to do a sad trombone routine for a few months straight. That’s the only way the Fed will even consider changing its “higher for longer” policy stance. And trust me, that’s a tough nut to crack.

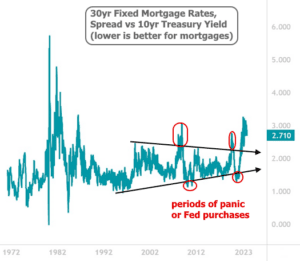

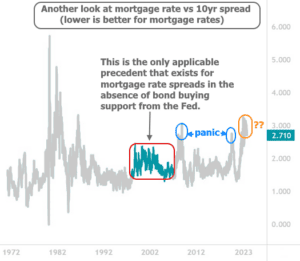

But hey, there’s hope on the horizon. Some folks out there believe that if the gap between mortgage rates and 10-year Treasury yields could just narrow a smidge, we’d have more manageable mortgage rates. Take a look at this chart – it’s like comparing apples to oranges, but with interest rates!

And now, behold the magic of spreads! Subtract the blue line from the orange one, and you’ll see why people are daydreaming about a more normal spread range. If we could get down to 2%, we’d be back in the high 6% range for a 30-year fixed. Hallelujah!

But hold your horses, my friends. Some experts are talking about spreads as narrow as 1 to 1.5%, and that’s about as likely as finding a unicorn in your backyard. To understand why, let’s take a quick trip down memory lane to the Fed’s role in the mortgage market.

Back in 2009, the Fed started buying oodles of mortgage-backed securities to prevent another financial crisis. That calmed investors down and brought spreads to more reasonable levels. But guess what? The Fed couldn’t stop buying MBS without things going haywire. And even when they tried to reduce their holdings in 2022, spreads went on a wild ride. It’s like trying to stop a snowball rolling downhill.

So, long story short, don’t expect spreads to magically shrink anytime soon. It’s like hoping for a unicorn to deliver your morning coffee. If 10-year yields hit 3.5% and spreads chill at 2.0%, we’d see a 30-year fixed mortgage rate at 5.5%. That’d be a game-changer, but don’t bet on it happening overnight.

So, there you have it, the thrilling saga of mortgage rates in all its rollercoaster glory. Remember, folks, the world of finance is like a box of chocolates – you never know what you’re gonna get! Stay tuned for more twists and turns in this wild ride.