If you’ve ever tried to follow the rhythmic pulse of housing market data, you’d know that it has a thing for fashionably arriving all at once, like a surprise birthday party where you’re the last to know. Well, this week was the bash, and the main headline was, “Hey, it could be worse!” Some brave souls even ventured to label the housing market as ‘resilient,’ especially when looking through the monocle of rate landscapes.

Before we dive into the pool of resilience, let’s dip our toes in the refreshing water of ‘rate landscape.’ The bond market, the puppeteer of interest rate movement, has been lounging sideways like a sunbather, while investors chew on their popcorn, eagerly watching the drama of subsiding inflation. The Federal Reserve decided to freeze the policy rate during last week’s meeting, but considering the bond market had anticipated this move, the reaction was less of a gasp and more of a polite golf clap.

Fed Chair Powell, ever punctual, decided to spill more tea in his regular congressional testimonies this week. We already knew the average Fed club member expected a couple more hikes before reaching the rooftop party level, given the economy sticks to its routine diet and exercise. But, Powell was kind enough to define ‘routine diet and exercise.’

Intriguingly, these hikes aren’t a reward for inflation or economic growth gaining muscle. Instead, the Fed’s fortune cookie reveals continued chill vibes in the labor market, humble economic growth, and a cooling trend in inflation. Simply put, inflation and the economy only have to tiptoe over a very low bar to warrant a few more rate hikes. For the Fed to call in sick, things would have to take a nosedive. On the flip side, if things start looking up, we may see more than just two extra hikes on the horizon.

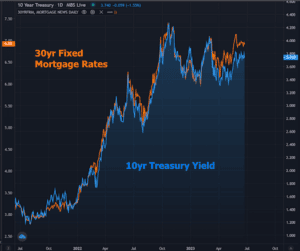

The heartburn with these expectations lies in the erratic weather forecast of the economy. Economic jitters usually manifest as the bond market doing the cha-cha slide. A good example of this is the 10-year Treasury yields playing the role of a stand-in for other rates (like mortgages), and showcasing some serious dance moves.

In it for the long haul? Here’s a nice overview of the rate landscape. In essence, rates are soaring like kites—not as much as the stratospheric heights of late 2022 or early this year, but surely closer to the eagle’s nest than the chicken coop over the past few years.

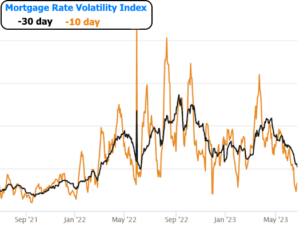

The rate rocket launch in 2022 predictably gave the housing market a touch of vertigo. But, even though rates are on the high wire, the market seems to have taken a chill pill and the volatility has mellowed out.

Lower rate waves seem to have made housing find its sea legs. It’s like each housing report this week was singing the same tune, but in different keys. Some reports were positively belting it out, highlighting the leap in ‘housing starts’ (an elegant way of saying “Let’s start digging!”). We’ve only seen 10 higher peaks in over a decade.

There’s been a big U-turn in new construction trends. Last month was singing the blues with the worst year-over-year growth in 14 years, but the latest report was belting out power ballads with the best growth in over a year—a complete 180 of more than 20%.

Sure, this data set might be as predictable as a cat on catnip, but wild

swings like these still have analysts scratching their heads and reaching for their crystal balls. A frequent refrain among the chatter is the significant and steady role played by multi-unit construction. It appears multi-family starts are at their zenith, untouched by the 2022 rate tsunami.

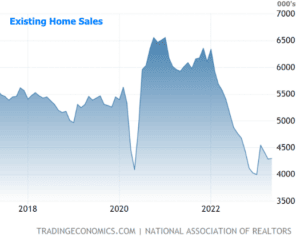

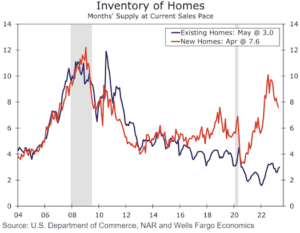

The other ‘hold your horses’ moment is that the new home market is the little brother to the existing home market. The latter is more accurately described as ‘doing the doggy paddle,’ even though recent numbers showed a slight breaststroke above last month.

The counterargument to that ‘hold your horses’ moment is that a lack of inventory is pulling back on the reins of the market.

Keep your eyes peeled for a few more heavyweights of the monthly housing reports dropping next week. Most are scheduled for a grand entrance next Tuesday morning, with New Home Sales expected to stay steady as she goes at an annual pace of 670k. In the meantime, the tag team of home price indices from FHFA and Case-Shiller are likely to show a more relaxed, near-zero price growth. Finally, Thursday’s Pending Home Sales index is anticipated to display a 0.2% growth after playing it cool last month.