It was nearly impossible to avoid news regarding the debt ceiling this week, but how much does it actually matter?

Let’s make sure we’re on the same page first. What follows are a few NONPOLITICAL thoughts on the debt ceiling, which is different than a “default.”

The debt ceiling has to be increased periodically in order for the US government to borrow enough money to fund day to day operations. There’s theoretically a point at which the government doesn’t have enough money to make payments that it had already agreed to make in the past. That money can come from the issuance of Treasury debt (i.e. borrowing) or from sources of revenue (such as taxes).

In that theoretical scenario, the US could default on its obligations and that would be incredibly serious. A missed payment on Treasury bills, for instance, could cause major fallout in financial markets. It has never happened and is all but guaranteed to not happen this time either. We can’t know with certainty exactly how long the government could make ends meet if it really had to, but it’s certainly longer than claimed, regardless of any drop dead dates you may see in the news.

That leaves us with what is mostly an exercise in political theater and/or brinksmanship on both sides of the aisle (no value judgments in this newsletter, ever). Despite that, some traders take logical, defensive measures JUST IN CASE this happens to be the time where we finally see a default (even if it’s very temporary and heavily qualified).

Those defensive measures cause volatility in certain corners of the bond market that end up spilling over to other parts of the market. Additionally, the broader topic of the debt ceiling is generally negative for risk assets like stocks and positive for longer-term bonds. Conversely, when a deal is announced, bonds could take a hit, thus pushing rates even higher.

From a more practical standpoint, a debt ceiling deal would reinstate the US government’s ability to borrow money via the issuance of Treasuries, and Treasury issuance correlates directly with interest rate levels (more issuance = higher rates, all other things being equal).

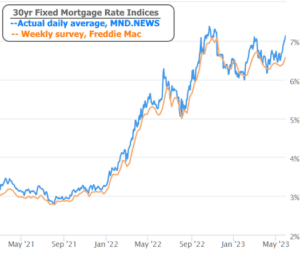

All of this is happening at a time when rates are already under pressure to move higher. Mortgage rates, for instance, shot back over 7% this week for the first time since early March.

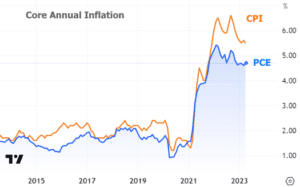

This has nothing to do with the debt ceiling and everything to do with the steady message from the economy and the Federal Reserve. To be fair to the Fed, their message will depend on inflation and the economy, and the Fed’s reaction function has been consistent: until inflation is clearly heading back toward 2% targets, rates need to stay high. And here are the inflation indices the Fed would like to see at 2%:

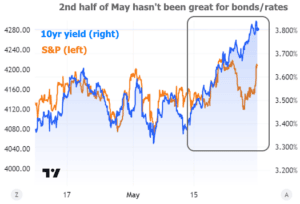

Inflation may have leveled off, but it’s been frustratingly unwilling to decline in any meaningful way. Some say that’s coming. Others say it will take longer than most people think. All the Fed can do is continue to wait for clearer signs from the data, and the data has generally not been kind to rates in the 2nd half of May.

Futures traders now see only a 1 in 3 chance of the Fed holding steady at the June meeting in several weeks. Rate hike expectations have moved steadily higher in concert with longer-term rates.

After a market closure on Monday for the Memorial Day holiday, market participants and the Fed will both be treated to 4 days of economic data with far more power to influence the rate outlook than anything we saw this week. Chief among the upcoming reports is next Friday’s big jobs report. 2 weeks later, the next installment of the Consumer Price Index (CPI) will sneak in just before the buzzer on June 13th as the Fed begins its 2 day policy meeting resulting in a rate hike decision at 2pm ET on June 14th.

One CPI report isn’t enough to determine whether the Fed has finally reached the “pause” phase of this rate hike cycle, but it could certainly sway the decision at this meeting (if next week’s data leaves anything to doubt, and it probably will).

Bottom line: rates have risen for real economic reasons and they could go even higher if those reasons show little sign of reversal.

Subscribe to my newsletter online at: http://mortgageratesupdate.com/acelandmortgage