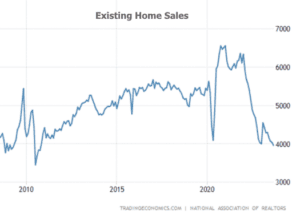

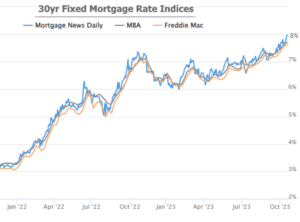

Well, folks, hold onto your hats because mortgage rates have finally busted through that 8% ceiling this week! It’s like they’ve been playing a game of limbo for months in the 7% range and decided, “Hey, let’s touch the sky!” Meanwhile, Existing Home Sales have plummeted to levels we haven’t seen in forever. It’s like the real estate market is on a rollercoaster, and we’re holding on for dear life. But hey, in the world of finance, there’s always some silver lining and maybe even a little too much optimism floating around. So, let’s dive into this warm bowl of porridge and see what’s cooking.

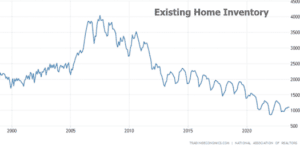

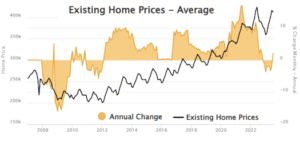

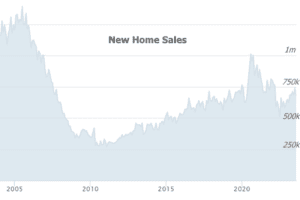

Behold, the not-so-great charts of home sales and interest rates.

I swear they don’t make for a pretty sight. But here’s the twist – unlike the last time home sales hit rock bottom, we’re in the middle of a supply shortage, not a glut. This means the housing market is as tough as a tank. In fact, in year-over-year terms, prices are giving us a thumbs up.

But wait for it… when we shift our gaze to new home sales, things suddenly brighten up. These sales are nowhere near their 2010 levels.

You’ll see that they’ve been on a steady climb, and now they’re back to pre-pandemic levels. Hope is like a phoenix rising from the ashes!.

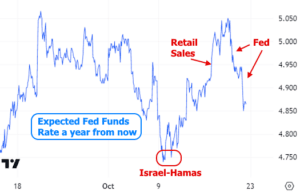

Now, let’s take a sip of that optimistic Kool Aid. Some folks are saying that the Federal Reserve is putting its foot down and saying, “No more rate hikes unless inflation goes wild.” Just this week, that sentiment did a 180 after strong Retail Sales caused Fed rate expectations to skyrocket on Tuesday. But by the end of the week, those expectations came down a peg, and the market’s looking at next year’s Fed Funds Rate as just a smidge lower.

ow, the “warm bowl of porridge” is somewhere between gloom and hope. It’s like the Goldilocks of the financial world – not too hot, not too cold. But defining it perfectly is like trying to catch a unicorn. There are scenarios where rates might gradually drop from here, or it might take months. Some say it’s already overdue, while others are like, “2025, here we come!”

But hey, the outcome depends on economic data, and the Fed is cautiously optimistic. They won’t freak out if unemployment stays low and GDP goes up. As long as inflation behaves and the economy doesn’t go turbo, they’re pretty chill about rate hikes.

However, don’t think the Fed is retiring to the beach just yet. Nope, they’re just switching gears. It’s less about more rate hikes and more about how long they’ll keep rates steady. And guess what? Markets like to beat the Fed to the punch. So, if they see data that suggests the Fed is thinking of cutting rates, they’ll make it rain lower consumer rates.

Now, after a wild two weeks of Fed speeches, we’re entering a scheduled blackout period. The next announcement is on November 1st, and they’re not expected to hike rates. But we’ll be all ears for any changes in their fancy words.

In the meantime, the upcoming week of data isn’t as crucial as the one after that. We’ve got our eyes glued to the jobs report due out on Friday, November 3rd. If it’s all doom and gloom, Team Gloom gets a point. But if it’s sunshine and rainbows, that Kool Aid will start looking mighty tempting. Cheers to the financial rollercoaster! 🎢