Seemingly overnight, the internet is awash with news regarding a “new,” unfair tax on mortgage borrowers with higher credit scores. Some have gone so far as to suggest that someone could intentionally lower their credit score in order to get a better deal.

Before you stop paying your bills in the hope of cashing in, let’s separate fact from fiction. First and most importantly, you will absolutely NOT get a better deal on a mortgage rate if your credit score is lower, even if your nephew just texted you a screenshot of a news headline saying “620 FICO SCORE GETS A 1.75% FEE DISCOUNT” and “740 FICO SCORE PAYS 1% FEE.”

So why would your nephew make such a claim?

This all has to do with changes to Loan Level Price Adjustments (LLPAs) imposed by Fannie Mae and Freddie Mac (the “agencies”), the two entities that guaranty a vast majority of new mortgages. LLPAs are based on loan features such as your credit score and the loan-to-value ratio among other things. They’ve been changed several times over the years and a fairly substantial change was announced in January of this year.

Wait… This news is from JANUARY?! Why are people talking about it now?

Yes, in fact, we already told you about it. People are confused because they don’t understand how “delivery dates” work when it comes to Fannie and Freddie. Changes that impact fees and guidelines are almost always implemented based on the date the loan in question is “delivered” to Fannie/Freddie. “Delivery,” in this context, typically occurs a matter of weeks AFTER the loan is closed, although it can be more than a month.

Now consider that a closed loan has often been quoted and locked for more than 3 weeks–call it a month to be safe. Since these changes go into effect on loans delivered on or after May 1st, 2023, lenders began to implement them weeks ago. Many lenders implemented them months ago–especially for loans that are locked for longer periods of time.

So low credit borrowers are already getting a discount while high credit borrowers pay more?

Not exactly, and this is where the confusion comes in. Also, from here on out, please note that there is no opinion offered here as to whether this is good/bad/etc. The only goal is to clear up confusion and offer facts.

The fact of matter is that LLPAs are indeed changing in a way that improves costs for those with lower credit scores and increases costs for those with higher credit scores (in many cases, anyway). But people are confusing the CHANGE for the ACTUAL cost.

So a low credit borrower isn’t paying less than a high credit borrower? The gap between what they pay is just smaller than it was?

YES! Again, all value judgements and political commentary aside, the change amounts to a tweak of an existing fee structure in favor of those with lower credit scores and at the expense of those with higher credit scores, but there’s no scenario where someone with lower credit will have a lower fee. In other words, don’t go skipping those credit card payments in the hopes of getting a lower rate.

How about some color-coded charts/tables?

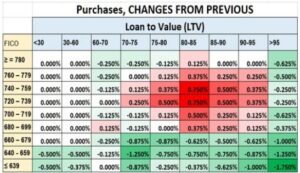

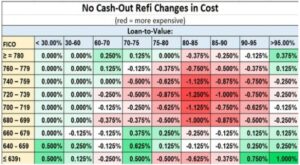

I thought you’d never ask. Let’s start with the changes that have everyone so upset. The following tables shows the DIFFERENCES in LLPAs before and after the change. RED = rising costs. GREEN = falling costs.++

If you only saw this chart, you could be forgiven for thinking someone with a 640 credit score was paying less than someone with a 740, but again, these are just the changes.

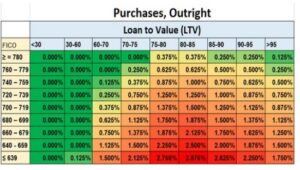

Now let’s look at a table with OUTRIGHT LLPAs for the same matrix of credit scores and loan-to-value ratios. This is the NEW structure, after the implementation of the change.

As you can now plainly see, if you have a score of 640, you’ll be paying significantly more than if you had a 740. Using an 80% loan-to-value ratio as an example, your LLPA at 640 is 2.25% versus 0.875% for a 740 score. That’s a difference of 1.375%, or just over $4000 on a $300k mortgage. This is almost HALF the previous difference, and that’s certainly a big change.

Yes, it’s a big change, so why is the government doing this to people with higher credit?!

Fannie and Freddie technically have a “mission” to promote affordable home ownership. Here is the statement on the topic by their regulator, the FHFA: FHFA Announces Updates to the Enterprises’ Single-Family Pricing Framework.

Note in the first two tables that there is more of an improvement for the lower FICO rows on PURCHASES (i.e. home ownership vs refis).

Any other misconstrued news I need to know about?

Yes, actually. While not as viral as the LLPA stuff, there has been a fair amount of press on a new 40yr FHA mortgage. THERE IS NO NEW 40yr FHA LOAN! Lenders who collect payments on FHA loans have a new option to offer loan modifications with terms of 40 years to borrowers who are unable to pay their existing FHA loans.

Don’t you usually talk about financial markets in these newsletters?

Indeed! But since we’ve taken a fair amount of space on more interesting stuff above, we can keep the market recap fairly short. Rates moved higher to start the week as economic data was strong on Monday morning. There were several other examples of reactions to economic data at home and abroad as the week continued, but all of them played out in a sideways range that continues to wait on the first two weeks of May for the most relevant input.