Oh, interest rates, the zesty roller coaster ride we never signed up for! Since the start of 2022, they’ve been acting like an over-caffeinated squirrel, bouncing all over the place. That’s when the Fed, acting a bit like a stern parent, began raising rates at a pace that could make a cheetah look slow. And why? To tackle a similarly hyperactive spike in inflation.

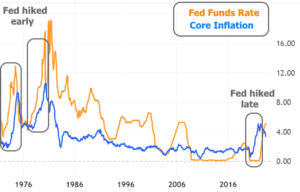

Now, this era of Fed rate hikes is not just aggressive; it’s like a coffee-addicted economist on a mission. The Fed came late to the inflation party, arguing that policies needed to remain as cozy and warm as your grandma’s blanket, all because of the economic uncertainties surrounding the old virus we know and love. A real contrast to the disco-era hyperinflation of the late 70s. Check out the chart below where the orange line (Fed Funds Rate) struts its stuff higher, sooner, and bigger than inflation. It’s like the opposite of your savings account interest these days.

As rates have skyrocketed, we’ve seen some moments of “Ah, sweet relief!” only to be followed by “Wait, what?” Several attempts at relief have been more thwarted than a cat trying to catch a laser dot. Every hope has been dashed, including the most recent one, which gave us a good show of a “higher for longer” reality, a phrase we were all pretending not to understand.

The fun fact? Rates have been strutting near their highest levels in 23 years, and no, not every rate index is over 7%, but some include upfront “points” that, like hidden fees on a vacation package, make other indices appear slightly lower.

Is there a glimmer of hope, you ask? There’s always hope, dear reader, just like there’s always another piece of chocolate in the fridge (hopefully). Timing is key and will depend on economic data, inflation, and possibly the alignment of the planets.

Earlier, rates were in a frenzy, acting like they’d just seen a ghost. But things cooled down a bit with the big jobs report from the Labor Department, proving that even economists can be surprised.

The core of the rate market? U.S. Treasuries, which behave much like your cat around dinner time – unpredictable. Mix in some ADP data and a Treasury announcement, and you’ve got a plot twist that would make a soap opera proud.

Despite Friday’s recovery, current rate levels are still closer to long-term highs than most of us are to winning the lottery. But there’s always “hope,” that magical word that keeps us all dreaming.

So, what’s the next headline-grabbing economic report? Drumroll, please… The Consumer Price Index (CPI) on Thursday, August 10th! It’s the only report that could compete with the jobs report for the past two years in the high-stakes game of “Rate Impact.” If inflation pulls a rabbit out of its hat and is lower than expected, it might just be a step in the right direction, one that hopefully lets rates cool down after this week’s run toward long-term highs. Until then, buckle up, and enjoy the ride