Hey there, financial adventurers! Grab your snorkels because we’re diving deep into the unpredictable ocean of mortgage rates. And guess what? It’s been a wild ride with twists and turns that even a rollercoaster would envy! So, let’s break it down with a sprinkle of humor, shall we?

Picture this: not too long ago, the top-tier 30-year fixed mortgage rate was scaling heights we hadn’t seen in 23 years. October 19th felt like the financial equivalent of scaling Mount Everest. Fast forward to this week, and we’re not exactly sipping champagne in our hammocks, but we’ve made a dent in those lofty rates.

In just three short days, we witnessed a whopping 0.50% drop in rates! That’s like finding a fifty-dollar bill in your old pair of jeans—unexpectedly awesome!

Now, let’s talk numbers. The rate improvement from Wednesday to Friday was the third biggest in over a decade. And if we conveniently toss out March 2020 (the wild child of volatility thanks to the pandemic), we’re left with only one other example, way back in November 2022.

Oh, the déjà vu! Last November’s rates took a nosedive too, but only after they’d reached the stratosphere of super-long-term highs. It’s like they were playing a game of financial limbo, seeing how low they could go after reaching for the stars.

But hold your horses, it’s not all randomness here. This rate drop dance isn’t just a reaction to previous rate spikes; it’s like the universe adding some “oomph” to the next big drop. You know, a little extra flair for the show.

Last November, the stars aligned because the Consumer Price Index (CPI) decided to take a nap, giving investors hope for a break from inflation. Sadly, that hope was as fleeting as the last cookie in the jar, and rates kept heading south until February 2023. It’s been a bumpy ride since then!

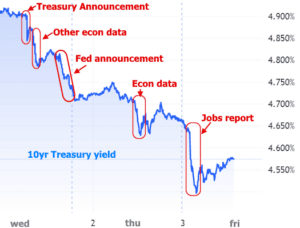

This time around, economic data played its part again, but it didn’t go solo. The good times began on Wednesday when the Treasury announced lower-than-expected auction amounts. Treasury supply has been the hot gossip in rate town, with supply increasing faster than a toddler’s growth spurt. More supply usually means higher rates, and nobody wants that!

But guess what? The market expected even more supply, and when the Treasury hinted at a slowdown, the bond market threw a party. It was like telling a marathon runner they only had one lap to go!

The rally continued with economic data and the Fed announcement, making Thursday look mellow in comparison. But it kept the momentum going, thanks to slightly higher Jobless Claims data and traders ditching their bets on higher rates. When you stop betting on something, it’s like swapping your ice cream for salad. Bond traders had to buy bonds to end their “higher rates” bet, and that pushed rates down.

With all the improvement on Wednesday and Thursday, Friday’s jobs report was like the grand finale. Would it rain on our parade? Nope! Jobs came in lower than expected (good for rates), the unemployment rate went up (good for rates), and past job gains were revised lower (good for rates, again!).

The job market is still strong, but it’s like going from a superhero to just a regular Joe. The result? The best three days for mortgage rates and bonds since the time rates decided to go on a mountain-climbing expedition.

But wait, before you start booking your beach vacation with all the money you’re saving, remember this: it’s like winning a battle but not the war. Rates have been on a relentless uphill journey since late July, and we’ll need more time and data for a full recovery.

So, my fellow financial explorers, keep those life vests handy because we’re still navigating these unpredictable waters. This victory is sweet, but it’s just a chapter in the epic novel of mortgage rates. The story’s not over, and there might be some plot twists ahead. But until then, let’s raise a toast to lower rates and the hope for calmer seas! 🌊💰