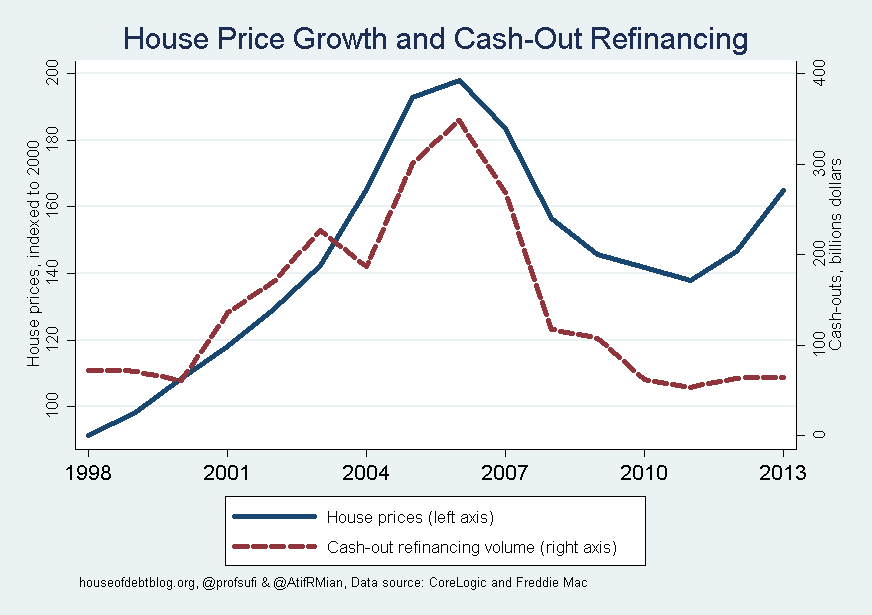

Home equity values at the end of the fourth quarter in 2013 hit their highest level since 2007. Much of this rise in equity is attributed to the rise in home prices throughout the past year due to investors buying foreclosures. The demand created by the investors looking to buy houses a low cost, renovate and sell at a profit; has increased home values overall. Financial advisors are cautiously optimistic on this rise in home equity. They cite that increasing home values lead to greater consumer confidence and spending.

The difference in the equity values between now and 2007 is what consumers are doing with their equity. In 2007 many homeowners with significant equity were choosing to do a cash out refinance. The volume of cash-out refinance loans was more than tripled in 2007 than in the last quarter of 2013. Most often the consumers who were borrowing large amounts of cash against their homes had lower credit and were over extending themselves with their spending. As a whole both consumers and lenders are much more conservative with the equity in their home now. This attitude will allow home equity to rebound at a safer rate that can prevent another housing collapse.